Dillon Critique from: what's the DILL?

Friday May 7, 2024

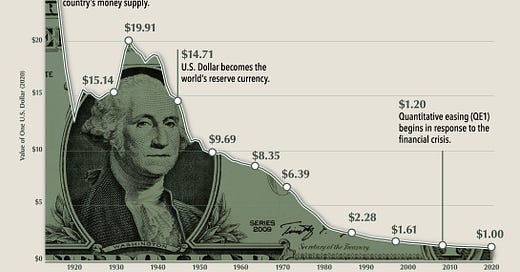

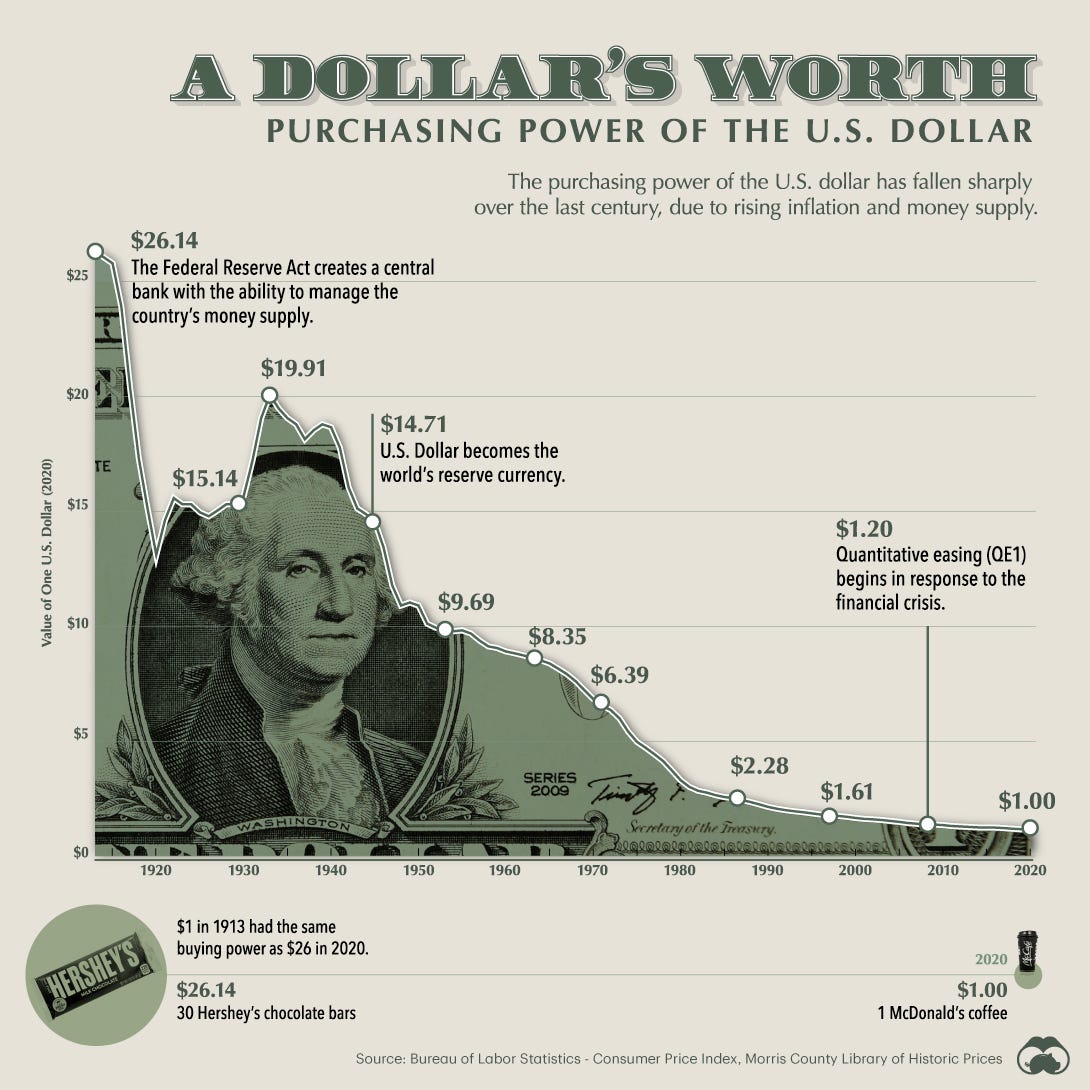

When your currency (Federal Reserve Note) has lost 98% of it's purchasing power (that's $0.03 purchasing power left out of the original $1.00), which is a public admission by the FEDERAL RESERVE EDUCATION BOARD (FRED)……

The talk of and the effects of policy such as; interest rates, Quantitative Tightening/Easing, Repo Market, Fed speeches and just about everything els mentioned and talked about in the financial media, is just irrelevant noise. A distraction.

WHY?

A currency that doesn't buy much of anything anymore, lessening by the day while the majority of the populace is no longer even receiving a living wage and nothing is being done to add value back to the currency. Is in such a deep state of collapse already, that rates, the VIX, Job reports, trade deficit, policy, Fed speeches and everything els being mentioned, highlighted or done policy wise, is completely meaningless. If your currency is ‘worthless’ (negative purchasing power), the policy or actions that surrounds that currency, are negligible. Unless the action is, that value is being added back or you completely transition to another system. Which we are in the middle of. A transition to World Government Centralized Digital Monetary Slavery (CBDC’s).

We can confidently assume the FRN’s (Federal Reserve Note) loss of purchasing power, is much worse than 98%. Why? The Federal Reserve doesn't and wouldn't tell the populace the truth. The Federal Reserve are liars. “Perception Management” managers who have a large vested interest in lying, whether they want to or not. Especially when the currency has already TECHNICALLY collapsed.

Which is why central banks around the world are hoarding Gold at never before seen levels and counting. Central Banks know what's in play (see bold print just below) and are taking actions while the public sleep walks into; COLLAPSE OF THE UNITED STATES, DOLLAR’S LOSS AS RESERVE CURRENCY AND TRANSITION TO CBDC MONETARY SYSTEM.

What’s Driving Central Banks to Record Gold Purchases — and Will It Last?

October 4, 2023

Head of Direct Retail

Global central banks posted their largest ever annual purchase of gold in 2022 — an estimated 1,083 metric tons. And the buying spree has continued, with 387 metric tons of net gold purchased in the first half of 2023.1

This trend is no surprise given how gold’s role in the global financial system and among central banks has evolved. Between the collapse of the Bretton Woods Agreement in 1971 and the early 2000s, central banks were mostly net sellers of gold. But in the aftermath of the Global Financial Crisis (GFC) of 2008, central banks became net buyers and have maintained this position ever since.

https://www.ssga.com/us/en/intermediary/etfs/insights/whats-driving-central-banks-to-record-gold-purchases-and-will

The system died in 2008 and has been on life support (QE + Low Interest Rates) ever since. That life support was cut when the Fed raised rates in 2022 on purpose to begin collapsing the system and begin the transition to the new monetary system of CBDC. Rate cuts are no longer a main policy procedure. The Fed will continue to pause and or hold or raise. They may cut for the election or some other psychological purpose.

99% of all topics in financial media serve as distractions from what matters most. Purchasing power, real money (Gold/Silver) and the real reality of the situation the US is already in, while people think it has yet to come. All of which are hardly ever talked about with any vigor in financial media.

If the citizens of a country are no longer receiving a living wage, while the currency’s purchasing power is negative and citizens are surviving off bank credit with no savings. Including having massive amounts of debt.

It's safe to assume the country and its currency, has already collapsed. People just haven't figured it out yet.

Working for a Living Wage

Written by: Rory Howard

Nearly half of Americans (44 percent) are not paid a living wage for their labor, which can be defined as the income necessary for a person or family to not only meet their basic needs, such as food and shelter, but also provide stability and financial independence needed for a good quality of life. What amounts to a living wage can vary based on the economic conditions of a particular area. More than half (56 percent) of workers who are not paid a living wage are in their prime working years (ages 25-50), and 43 percent are raising children.

https://ncimpact.sog.unc.edu/2022/07/working-for-a-living-wage/

For many American families a living wage is out of reach: Report

By

Sasha Pezenik

April 27, 2022, 12:01 AM ET

Cost-of-living crisis A new study suggests the wage many people earn does not nearly cover the amount needed for basic necessities, including child care.

https://abcnews.go.com/Health/american-families-living-wage-reach-report/story?id=84330584

(There is a lot of woke World Government Propaganda in this ABC article. Why? Because they are admitting that the dollar is dead while offering you World Government Solutions as a fix)

NEW DATA POSTED: 2023 Living Wage Calculator

Written by Dr. Amy K. Glasmeier on 02/01/2023

While the minimum wage sets an earnings threshold under which our society is unwilling to let families slip, it fails to approximate the basic expenses of families in 2022. Consequently, many working adults must seek public assistance and/or hold multiple jobs to afford to feed, clothe, house, and provide medical care for themselves and their families.

https://livingwage.mit.edu/articles/103-new-data-posted-2023-living-wage-calculator

Wage Stagnation in Nine Charts

Report • By Lawrence Mishel, Elise Gould, and Josh Bivens • January 6, 2015

Our country has suffered from rising income inequality and chronically slow growth in the living standards of low- and moderate-income Americans.

https://www.epi.org/publication/charting-wage-stagnation/

(The article states wage decline is due to “Income Inequality”. While partially true, the real reason is currency devaluation by the Federal Reserve)

Measured In Gold, The Story Of America’s Declining Wages Is An Ugly One

Today’s minimum wage employee works 12 percent longer to earn a gallon of milk compared to 1965, according to the Bureau of Labor Statistics. Today’s senior engineer works almost twice as long to buy a gallon of gasoline, according to the Department of Energy.

https://citizenwatchreport.com/measured-in-gold-the-story-of-americas-declining-wages-is-an-ugly-one/

While the currency’s purchasing power is negative and citizens are surviving off bank credit with no savings and massive amounts of debt…

Nearly Half of Americans Need Credit Cards To Cover Essential Living Expenses

The survey found that 48% of Americans depend on credit cards to cover essential living expenses. This is more common among younger generations: 59% of millennials use credit cards for living expenses. Conversely, only 29% of boomers rely on credit cards to cover essential expenses.

https://finance.yahoo.com/news/jaw-dropping-stats-state-credit-130022967.html#:~:text=The%20survey%20found%20that%2048,cards%20to%20cover%20essential%20expenses.

Most American adults don’t have enough savings to pay an emergency $1,000 expense

BYJANE THIER

February 1, 2024 at 1:33 PM CST

A stunning new Bankrate survey of 1,030 individuals finds that more than half of American adults (56%) lack sufficient savings to shoulder an unexpected $1,000 expense. Of that number, 21% said they would go into debt by financing the spending with a credit card

63% of workers unable to pay a $500 emergency expense, survey finds.

PUBLISHED THU, AUG 31 2023 3:14 PM EDT

Lorie Konish

Workers are reporting financial stress amid higher prices due to inflation and more expensive debt due to rising rates.

https://www.cnbc.com/2023/08/31/63percent-of-workers-are-unable-to-pay-a-500-emergency-expense-survey.html

Side Note:

This CNBC article goes perfectly with the two articles I wrote previously. Which stated the Federal Reserve raised interest rates to begin collapsing the system on purpose by hyperinflating the debt away and tightening credit (higher rates) to squeeze the public to death (inflation + higher rates) . You can find both articles here:

The Truth About Interest Rates, Hyperinflation &

Share this to get the word out to others! The Federal Reserve does not plan on cutting rates. Why? The Federal Reserve is purposely raising rates to (1) collapse the current system and make way for the new system of CBDCs. To (2) ‘burn off’ the debt through Hyperinflation with higher than usual interest rates, relatively speaking, while continuing…

Federal Reserve Playbook Revealed

CLICK to FIGHT BACK in the INFORMATION WAR! This article reveals what the Federal Reserve plans on doing regarding Interest Rates, Quantitative Easing and the effects it will have Interest Rates (1) The Fed will raise rates and or pause. The Fed does not plan on cutting. The Fed raised rates on purpose to begin collapsing the system. Reducing rates is no…

…The United States and its currency, have already collapsed. People just haven't figured it out yet.

ELEPHANT IN THE ROOM

Unfortunately, nothing can be done to fix our purchasing power issue. Besides transitioning to a new monetary system or rather, a return to the old. Sound money Gold/Silver. Which would be preferable.

We are and have been in the middle of a monetary and Empire transition. Unfortunately as expected, our overseers of course are taking the digital slavery route of CBDC. So we are infact getting a new system or a new “Bretton Woods”, as some like to say. The Fed will no longer be saving this current system. The Fed will try to make this transition as slow and unnoticeable as possible. Which will give people the indication, feeling or thought that the Fed is trying to save the system or prop the system up.

The Globalist/Central Planners despise sound money for the general public, despise having a lack of control over the population and 100% monetary and economic control.

As of current, nothing will change until something is done about purchasing power. Until something is done about our purchasing power issue, our standard of living/society will continue down the shitter. You can not out hustle currency devaluation and you can not out work currency devaluation. Pulling up your proverbial “bootstraps”; ‘jus ain’t’ gon’ cud-dit’.

We are all slaves to purchasing power, just as a day trader is a slave to volatility.

Millions of households teeter on brink of poverty despite employment; Federal Reserve runs into brick wall

By Jessica Dickler

In the grand tapestry of American life, a tragic saga unfolds, weaving together the destinies of countless families ensnared in the relentless grip of economic hardship. Across the land, the toll of financial strife reverberates, echoing the plight of 29% of households—laboring tirelessly, yet teetering perilously close to poverty’s abyss. Each paycheck, a fragile lifeline, holds at bay the specter of destitution, but the shadow of uncertainty looms large, for these families are but one emergency away from the precipice.

https://citizenwatchreport.com/29-of-households-teeter-on-brink-of-poverty-despite-employment-federal-reserve-runs-into-brick-wall/#google_vignette

During collapses, governments always lie about employment, among everything els drastically. Which is a governments natural state anyway, to lie. However, this is delusional steroid levels of propaganda, to which the goal is to keep the publics eyes and mind hidden from the absolute desolation that's already occurring, yet everyone seems to be oblivious to.

America & the USD has Already Collapsed

People Just Haven't Figured it Out Yet

The True Rate of Unemployment is 24.2% according to the Ludwig Institute

From a previous Forbes article, going back 4 years, quote:

“It is estimated that unemployment hit 24.9% during the Great Depression.”

https://www.forbes.com/sites/chuckjones/2020/05/19/3-reasons-unemployment-is-already-at-great-depression-levels/?sh=55d248f413f1

I have been writing and stating for years that we have been in a recession since 2008 (papered over by QE & low interest rates) and a depression since 2020. You can find my older work about that here:

https://blackboxpolitic.wordpress.com/2022/06/11/america-is-in-an-economic-depression-greater-than-1929-part-1/

More than 1 in 3 Americans have more credit card debt than emergency savings

https://www.bankrate.com/banking/savings/emergency-savings-report/

6 in 10 Americans don't have $500 in savings

https://www.cbs19news.com/story/34248451/6-in-10-americans-dont-have-500-in-savings

Americans have two jobs or more

https://www.usatoday.com/story/money/2023/11/03/more-americans-working-multiple-jobs-under-inflation/71441008007/

US credit card delinquency rates hit record highs in Q4 2023, signaling financial stress for consumers

https://www.bloomberg.com/news/articles/2024-04-10/credit-card-delinquency-rates-were-worst-on-record-in-fed-study

Credit card interest rates are at record highs

https://www.cnbc.com/2024/02/23/credit-card-interest-rates-are-at-record-highs.html

1 in 3 Americans maxing out credit cards because of inflation: survey

Millennials, especially, are dealing with record credit card debt

https://www.foxbusiness.com/personal-finance/credit-card-limit-debt-inflation

U.S. Families Skip Meals to Save Money

https://www.specialtyfood.com/news-media/news-features/specialty-food-news/u-s-families-skip-meals-to-save-money/#:~:text=Three%2Din%2Dfour%20consumers%20between,meals%20due%20to%20financial%20concerns

Homelessness in US surges to highest-recorded level

https://thehill.com/homenews/administration/4363103-homelessness-sours-highest-recorded-level/

Younger baby boomers are facing a homelessness crisis as rents skyrocket and outpace Social Security

https://www.businessinsider.com/young-late-baby-boomers-homeless-rent-social-security-2023-9

More Americans Are Ending Up Homeless—at a Record Rate

https://www.wsj.com/articles/homelessness-increasing-united-states-housing-costs-e1990ac7

Alarming Rise in Family Homelessness in the US Amidst Soaring Costs and Housing Shortages

https://www.linkedin.com/pulse/alarming-rise-family-homelessness-us-amidst-soaring-costs-arbetter

The following will be familiar to some of you already. Even so, this information bears repeating over and over and over to everyone until their ears bleed. Why? It drives home the reality that the US and it's currency has already collapsed. The full consequences of that reality are slowly playing out and is now being psychologically recognized and felt by the general public at large. Government lies are no longer enough to hide or cover up the reality. It is now simply laughed and scoffed at; yet at the same time, talked and reported on as if it's relevant or fact.

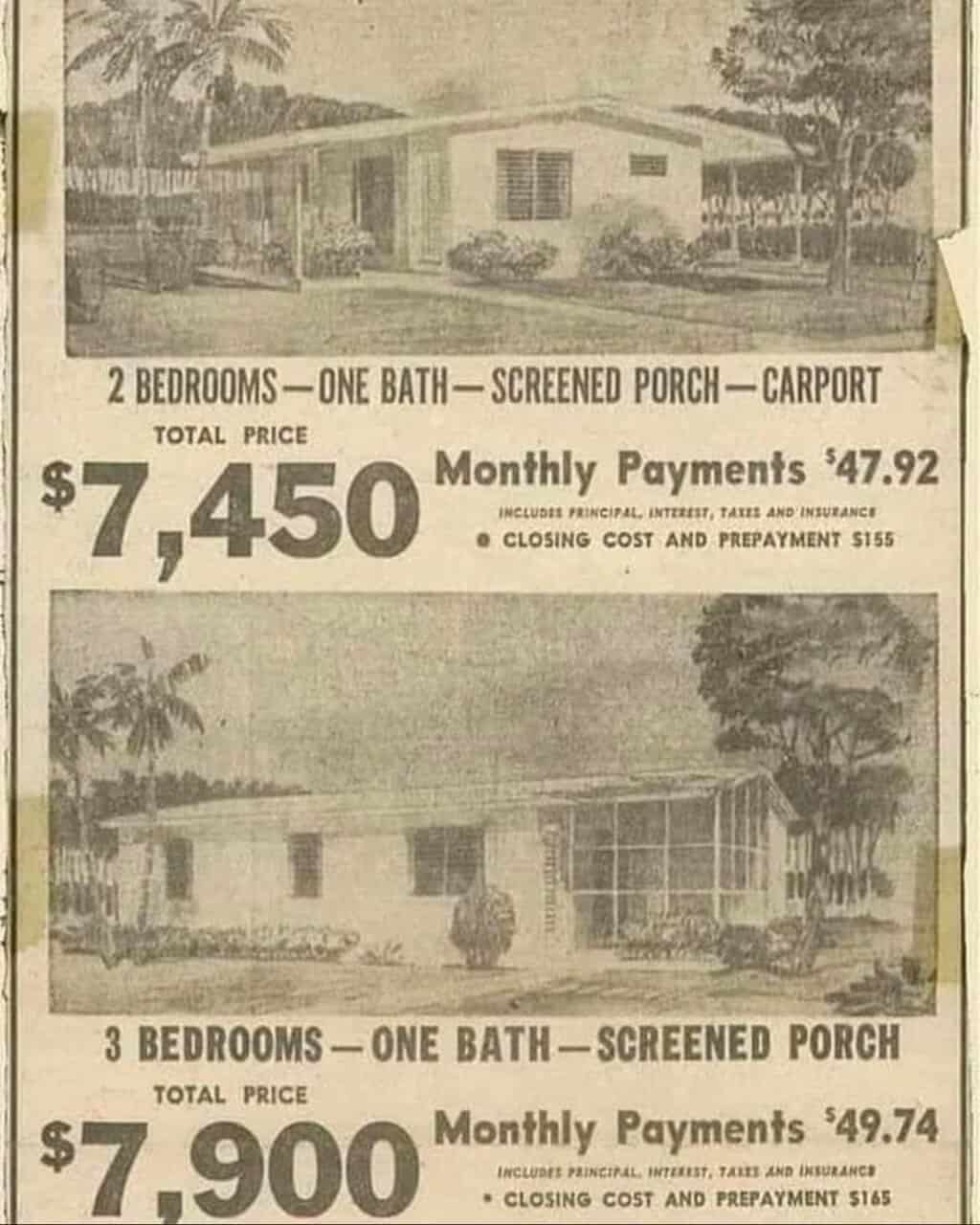

In 1970, the average salary was about $10,000. Gold was about $40 an ounce. At a salary of $10,000, you could buy 250 oz of Gold.

In 1970, a man could support a family of four or five. A wife who didn't have to work, kids, a house and vehicle.

Today (2024), the average salary is $40,000. Gold is about $2350 an oz. At a salary of $40,000, you can only buy 17 oz of Gold. While 250 oz of Gold, is now well over $500,000 in today’s purchasing power vs the $10,000 for 250 oz, in 1970.

The average wage of $40,000 today is not even enough to survive or live off of in the majority of the US.

(Late 1950’s housing Ad)

Typically once a country has already collapsed, Civil War or fears of a civil war foment. Fortunately, Americas enemies, foreign and domestic, have publicly stated they are actively destroying the US. I say fortunately because it is not hidden, it is no secret and it is not denied. We know what we face. America is under siege from within and has been for many many generations. The threat we face is in the open and not subject to question. There is a lingering question about said threat.

What the hell do we plan on doing about it as citizens collectively? Will we continue to sit on our asses and be collapsed, depopulated and forced into CBDC slavery? Will we watch each other go homeless and starve as we currently are doing? How bad do things have to get before we actually put enough effort into changing things like a return to sound money?

41% Of Americans Think Civil War Likely By 2029, Some Say Sooner Amid Chaos

BY TYLER DURDEN

MONDAY, MAY 06, 2024 - 07:40 PM

Americans have been stunned by the Democratic megadonors funneling money into Marxist groups, sparking mass chaos across colleges and universities nationwide as risks are mounting that 'BLM-style' riots could spill over into city streets this summer.

Law-abiding Americans have taken notice of radical left-wing policies pushing this nation further into chaos, from failed progressive cities ignoring law and order to open borders igniting the greatest illegal alien invasion this nation has ever seen. There is a growing sense among the population that possibly a controlled demolition of the country is underway by the radical left.

The spark that could ignite the next round of social unrest is possibly Marxist 'useful idiots' (some of which are professional and paid protesters) on school campuses who quite literally have said they want a revolution to usher in a "socialist reconstruction of America."

https://www.zerohedge.com/political/41-americans-think-civil-war-likely-2029-some-say-sooner-amid-chaos

“How long can we keep this up?” Food banks are under pressure from Texas’ high level of food insecurity

NOV. 28, 20235 AM CENTRAL

Inflation, stagnant federal funding for food programs and high housing costs mean that demand at food banks still hasn’t returned to pre-pandemic levels.

https://www.texastribune.org/2023/11/28/texas-food-banks-high-demand-snap/

Food Banks Running Low

https://www.pbs.org/newshour/classroom/daily-videos/2023/08/food-banks-running-low-during-recession

Food banks pushed to brink as they see ‘worst rate of hunger’ in years

By CNN Newsource

Published: Nov. 17, 2023 at 9:31 AM CST

According to USA Today, food bank CEOs say this is the worst rate of hunger they’ve seen in years

https://www.live5news.com/2023/11/17/food-banks-pushed-brink-they-see-worst-rate-hunger-years/

Latest Food Bank Survey Finds Majority of Food Banks Reporting Increased Demand

Feeding America May 2, 2023

For the month of March, nearly two-thirds of responding food banks reported an increase in demand for food assistance, according to Feeding America’s latest food bank pulse survey, a marked jump from the previous survey. In the latest survey, fielded between April 17 and May 1, around 95% of responding food banks reported seeing demand for food assistance increase or stay the same in March compared to February, with around 65% reporting an increase in the number of people seeking charitable food assistance. This is the first food bank survey gauging demand since the nationwide end of a critical pandemic-era food benefit.

By the end of February, around 20 more states stopped providing increased Supplemental Nutrition Assistance Program (SNAP) benefit amounts, known as emergency allotments. This additional assistance began in the early days of the pandemic to provide much-needed hunger relief. While the wind-down of the emergency allotments was always expected, the timing came as tens of millions of families are still feeling the stress of elevated food prices. Food banks anticipated an increase in demand given the sudden loss of billions in purchasing power for families. The latest food bank survey reflects this.

https://www.feedingamerica.org/about-us/press-room/latest-food-bank-survey-finds-majority-food-banks-reporting-increased-demand

Demand at food banks and pantries reaches ‘catastrophic’ levels

In the 10 years he’s been running a food pantry, Keith Bergey has never seen the situation as dire as it is these days.

“It’s catastrophic,” said Bergey, who runs Harvest of Hope Food Pantry at Saint Paul’s Union Church in York.

The pantry has just about reached its capacity to meet the demand for food assistance. The number of families who came through for the Thanksgiving holiday season alone was at a record high.