Share this to get the word out to others!

Written August 6 2021

By Dillon Critique from: what's the DILL? (Substack) & Blackbox Politic (WordPress)

Original Article Origin: https://blackboxpolitic.wordpress.com/2021/08/06/if-currency-velocity-rises-we-collapse-and-starve-to-death/

If you look at the Federal reserve chart of M2 currency velocity, it’s at historic lows.

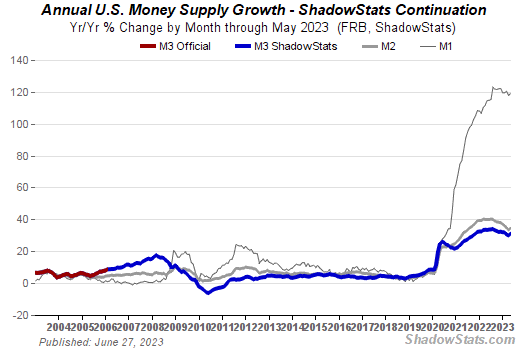

Meanwhile, M1 currency supply (Chart by John Williams of shadowstats.com) and M2 currency supply (chart by the Fed) is straight up and at historic highs.

(M1 by John Williams is more accurate and properly calculated. The fed use to use this method before manipulating and fudging the numbers to make the situation we are in not seem so apocalyptic.)

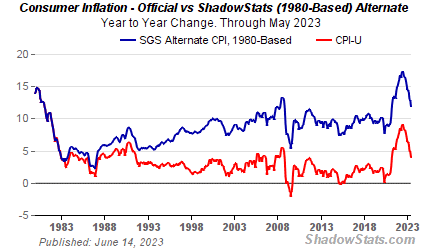

So with historic low currency velocity (M2 velocity by the fed), and historic high M1/M2 currency creation/currency within the system (M1 chart by john, M2 by the fed), we have 13.5% inflation (1980’s based metric used by John Williams at shadowstats.com).

So we have 13.5% real inflation (while the fed tells us it’s only 6%) with historic low currency velocity. If currency velocity picks up, 13.5% inflation could easily become 27% inflation. This will possibly lead to panic causing inflation to rise even more and faster which could lead to hyperinflation. More inflation would cause the fed to increase the currency supply faster with bigger deficits only increasing inflation even more and again leading to hyperinflation.

As a side note: To understand this, it’s important to understand how the fed currently calculates M1 and M2 supply vs how the fed USE to calculate M1 and M2 supply. John Williams utilizes the original proper calculations the fed use to use, for his M1 and M2 charts. Not the manipulated formulas they’ve been running for awhile and have even changed again. You can read that break down on his site.

John also uses the way inflation use to be calculated properly in the 1980’s, to get his inflation numbers (before the fed took out housing and energy etc for example).

The lockdowns serve World Governments purpose of an authoritarianism take over. It also serves the purpose of lowering currency velocity. Why? Less people ‘out and about’ spending, less businesses open, restrictions like limited capacity for thiose that are open etc. all lower currency velocity. With hardly any spending/velocity taking place (currency moving through the system/real economy), the Fed is essentially replacing spenders and ‘consumers’ (people) to prop up the system which has expanded their balance sheet by eight trillion dollars. This keeps large corporations and others “in the club” liquid, while the middle class and small to medium sized businesses collapse. This is of course is done by creating currency out of thin air, also known as Quanatative Easing or “Operation twist” type programs at 0%. This can be physical cash or more so digitally.

Some will argue, historic low velocity proves deflation. The problem is the fed is fighting off deflation WITH inflation. The Fed is purposely inflating the dollar. So there is more pressure on the inflation side of the equation stamping out deflation as an overall theme. Why? Even with historic low velocity, we are nearing depression level inflation of 1929, which was 17.1%. So imagine when velocity does pick up, if at all. That’s not to say there will not be any deflation. For example, stock prices will deflate, however, consumer goods like food, will skyrocket in price. I’m not ignoring the supply and demand side of the equation either.

By Dillon Critique from: what’s the DILL? & Blackboxpolitic.wordpress.com

Sources:

https://fred.stlouisfed.org/series/M2V

http://www.shadowstats.com/

alternate_data/money-supply-charts

https://fred.stlouisfed.org/series/M2SL

https://fred.stlouisfed.org/series/M2

(DISCONTINUED)

http://www.shadowstats.com/alternate_data/inflation-charts

http://www.shadowstats.com/article/no-438-public-comment-on-inflation-measurement

http://www.shadowstats.com