by Dillon Critique from; (SUBSTACK)

February 21 2025

https://www.blackboxpolitics.substack.com

It takes time, energy and effort to provide content. Please consider the following if you found any value…

PLEASE SUPPORT MY WORK BY EITHER; Subscribing, Following, Sharing, Liking, Commenting and or Donating...

DONATE (Stripe): https://donate.stripe.com/cN25mwbR35fq0c8288

US ECONOMY HAS ALREADY COLLAPSED

About 20% of those searching for work, have been looking for ten to twelve months, or even longer, without any luck; That’s according to a recent report by FORTUNE.

US hiring in private sector declined for 29 months STRAIGHT, the longest streak since 2008 Financial Crisis.

Hiring rate dropped to 3.6% in December, the second-lowest in 10 YEARS, nearly in line with the 2020 low.

The majority of jobs that do exist, do not pay a living wage due to the Federal Reserve’s endless onslaught by way of Hyperinflating the currency to death; in order to ‘burn off’ debt & transition to what I call the new: “Digital Monetary Surveillance System Economy DMSSE Crypto”.

Economy already collapsed + jobs shipped overseas; America was ransacked, pillaged & taken over long ago from within.

US Recession since 2008 that was papered over by QE & artificially low interest rates.

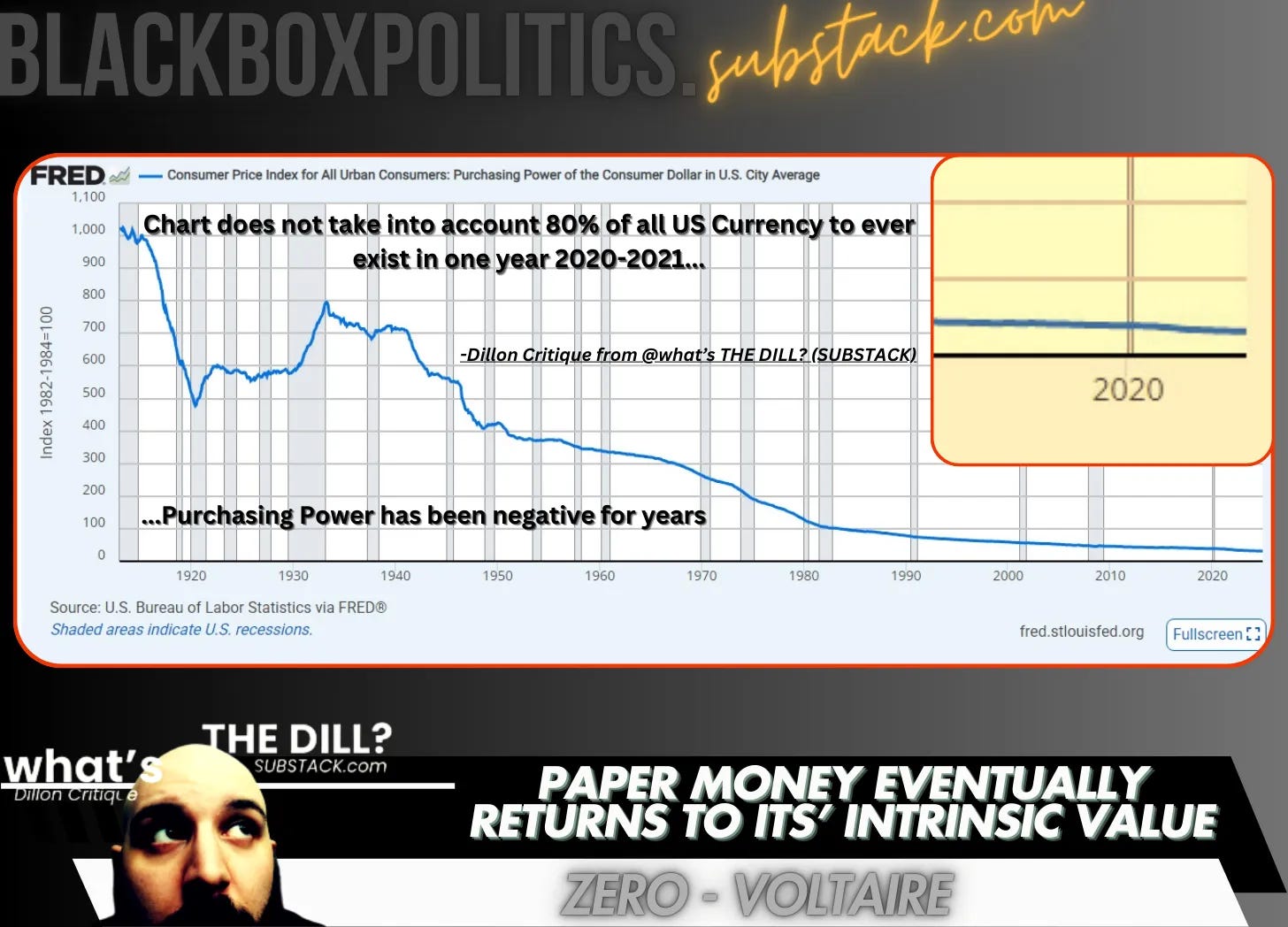

US “Hyper-Stagflationary Depression” since 2020 when the…

US created 80% of all US currency to exist in one year 2020-2021 with

Inflation already significantly high &

Currency velocity spiking at a 90-degree angle upward from an all-time US historic low.

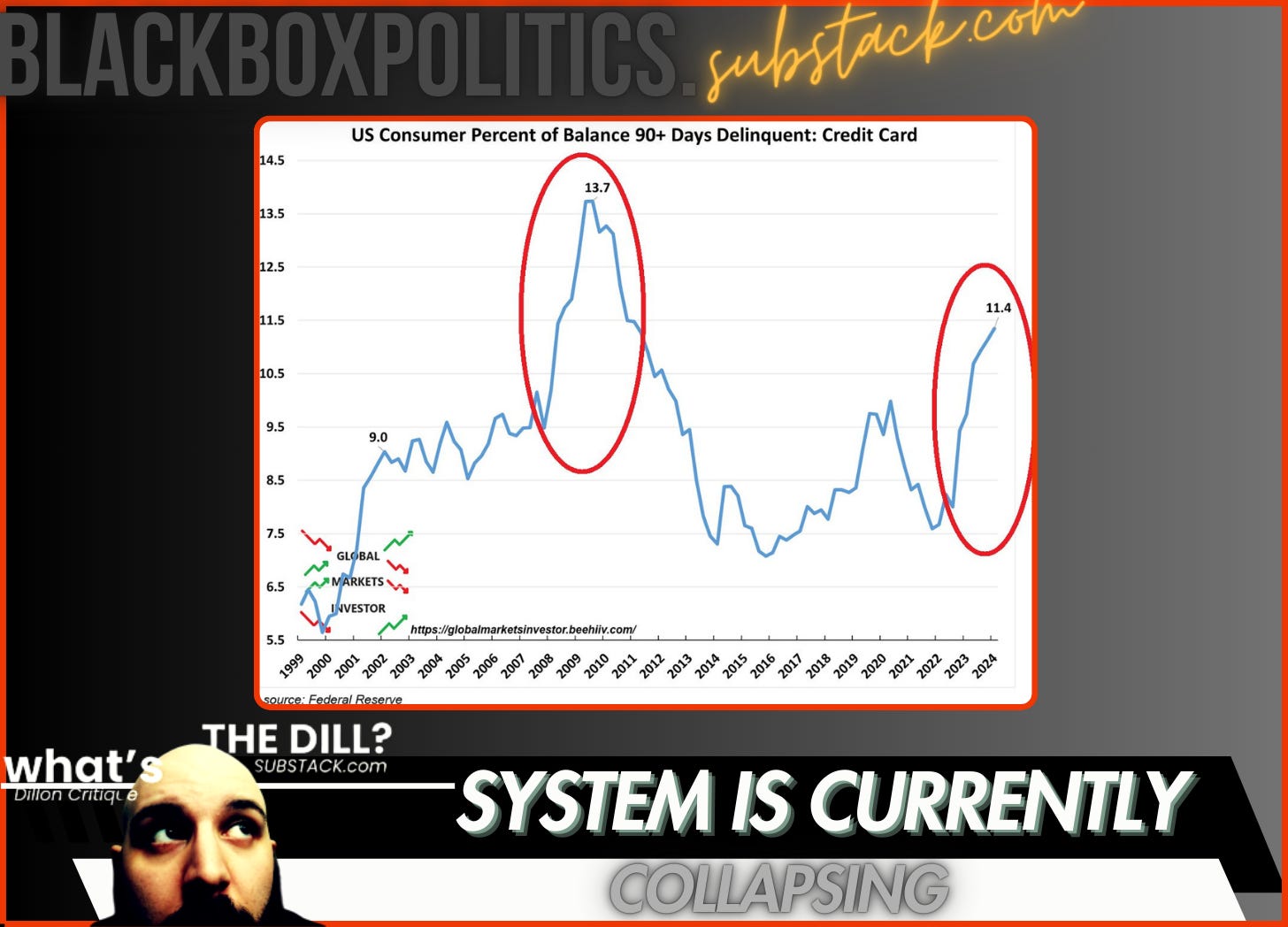

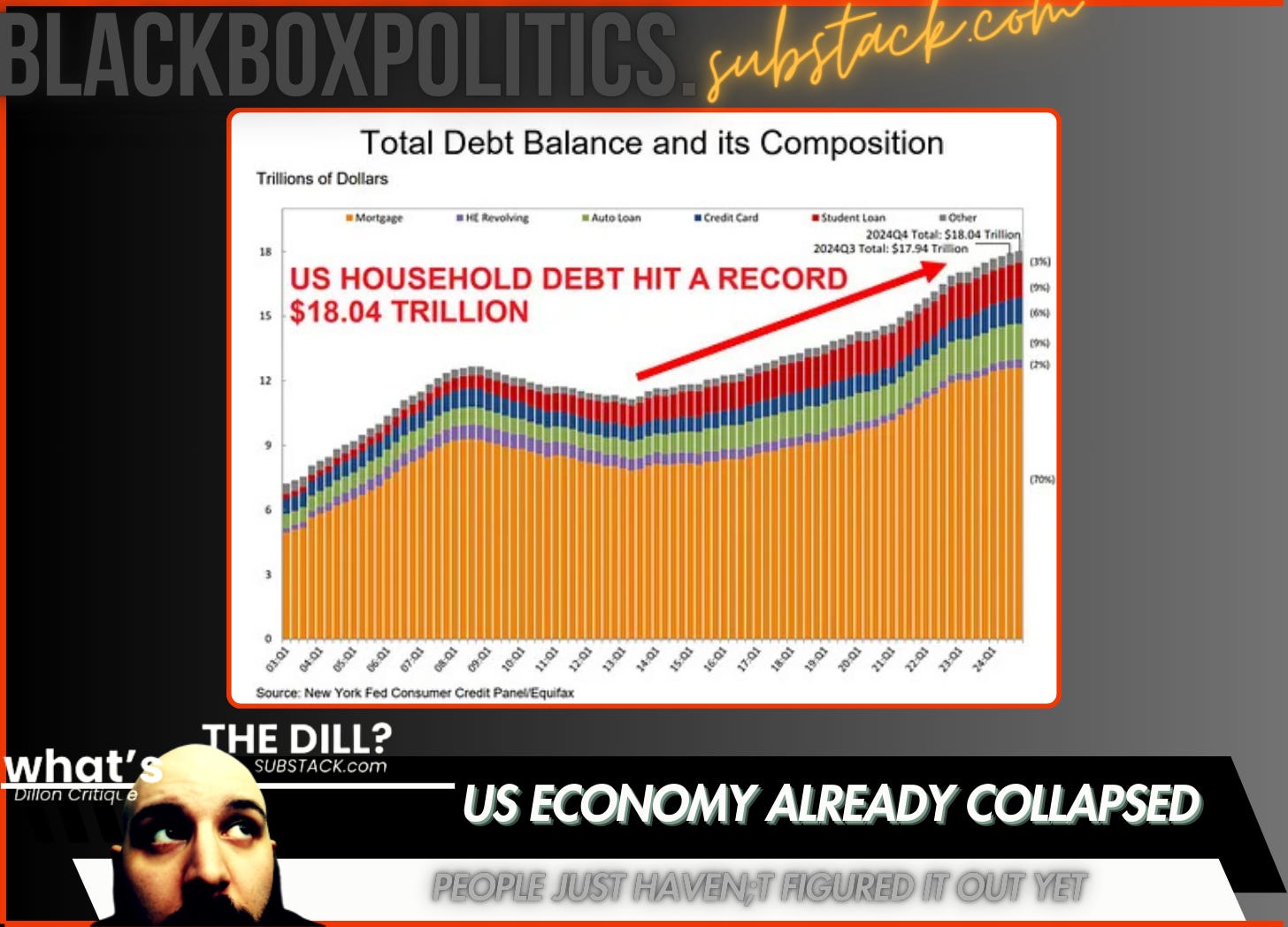

That is why the majority of American households literally live off & survive off credit/debt & not living wages.

That is why debt is continuously reaching new highs year over year as the Economy continues to collapse & the Dollar Hyperinflates.

Notice the consumer debt chart above shows a Hyperinflationary pattern like many of the other Hyperinflated charts I have shown in previous works.

GOLD’s WARNING SIGNAL…

Gold is up 50% in 14 months. A rise in gold price is an indication of a failing currency.

We don’t need a rise in Gold price to tell us that though do we?

The F.R.E.D admits on their own website the USD has lost 99% of its’ purchasing power since 1913.

Losing 99% of anything already indicates a collapse has already happened, whether you the individual is aware of it or not.

I find it “tongue in cheek” hilarious, when I see post that say, “Prepare for Dollar Collapse”, “Dollar Collapse Coming”.

It’s already been here and happened; People just have not figured it out yet

The USD has lost 99% of its’ purchasing power since 1913.

99% devaluation is a collapse, even though the USD is still accepted and used as a form of payment currently, which is waning.

Meanwhile, retail investors are piling into stocks and crypto at the fastest pace ever recorded…

…before the purposeful wealth transfer & rug pull as expected & warned about in great detail well in advance, in my previous articles.

As the public piles in to be the bag holders in the hopes of getting rich or fight inflation, Institutional Investors have been fleeing for years already, up to present day & piling into gold since 2018.

Institutional Investors have been selling tech sector + consumer discretionary & consumer services sector…because the US dollar and economy have already collapsed, people just have not figured it out yet.

Institutional Investors know something wicked this way cometh.

EAST CONTINUES DE-DOLLARIZATION IN NEW WORLD ORDER & MONETARY/WEALTH TRANSFER TRANSITION PHASE

China & Japan continue dumping US treasuries…

China reduced their position by $77 billion in 2024 to $759 billion marking the lowest point in 15 YEARS.

Japan sold $57.3 billion, down to $1.06 trillion making the lowest point since 2018.

Both China and Japan, are the largest foreign holders of US public debt.

THINGS ARE SO BAD DEBT CAN NO LONGER BE PAID BACK & IS GOING BUST; System is Collapsing on itself

Again, notice another Hyperinflationary pattern within this chart above as well.

US LARGE BANKRUPTCIES

In January, there were 70 US bankruptcy filings, in line with the largest monthly number since the 2020 CRISIS.

This comes after bankruptcies hit 694 in 2024, the most in 14 YEARS.

Bankruptcies are rising because the US Dollar & Economy have already collapsed and the proverbial chickens are coming home to roost.

2ND WAVE OF HYPERINFLATION ALREADY IN PROGRESS

As

(SUBSTACK) previously warned in 2020/2021, the first wave of Hyperinflation began when the US created 80% of all US currency to exist in one year 2020-2021 which you can see in the chart below.The first line represents 80% of all US currency created in one year 2020-2021

The second line represents the beginning of the second phase of Hyperinflation

The third line represents where the second wave of Hyperinflationary should go on graph

There could be some fudging of the numbers to make it appear as though gov spending has laxed. The system relies on increased spending to stay afloat; they plan to continue Hyperinflation in order to transfer us to the new system while killing off the old.

The above chart is US government expenditures, hitting a shocking $7.1 TRILLION over the last 12 months, the most in 4 years.

Only in 2020 (Preplanned Plandemic), the Engineered 2008 financial crises and World War II, saw higher government outlays as a percentage of GDP

CONSTRUCTION JOBS

Construction job openings have DECLINED in 12 months to just 165,000, the lowest in 8 YEARS

GOLD REVALUATION & WEALTH TRANSFER HAS ALREADY BEEN IN PROGRESS

As the public pile into crypto, stocks and debt…

Demand for physical GOLD in New York has never been greater…

Hiring fell to the lowest since the 2008 Financial Crisis while professional and business services have LOST JOBS for 17 months straight.

US hiring in the private sector has declined for 29 months STRAIGHT, the longest streak since the Great Financial Crisis.

Hiring rate dropped to 3.6% in December, the second-lowest in 10 YEARS, nearly in line with the 2020 low.

The reason why the US keeps breaking 2020 records as if it is nothing is because the US has already entered and been well into a worse financial & economic crisis than that of 2020 or 1929 the great depression.

The USD has already collapsed along with the economy and “experts” are sitting around talking about a Recession.

It takes time, energy and effort to provide content. Please consider the following if you found any value…

My biggest concern is how the real estate bubble is making real estate tax valuations go through the roof. If you can't afford to pay the tax you will be forced to sell your property at whatever the market value is at the time. Only tax exempt entities own their land. We might as well sell our homes and buy vacant land to camp on or squat on public lands because we won't be able to afford the taxes on any buildings. Gold can be converted into cash but when cash is no longer accepted as legal tender we'll be forced to convert it into CBDCs or cryptos. How will we pay our real estate taxes if they only accept digital currency? I've found no county governments in the U.S. that will accept PMs for payment of taxes.

Here in the Bahamas, 14 dollars for 12 eggs