The Greater American Depression of 2020 Worsens

Yet People Think Recession Hasn't Happened or is Just Beginning

May 4, 2024 Tuesday

by Dillon Critique

from; what’s THE DILL? (SUBSTACK)

Every Financial and or Economic Article/Video I tune into, has yet to understand America is and HAS ALREADY BEEN in a Depression since 2020. The general narrative you find is that of; “Recession Imminent?”. With current economic and financial data worse than that of 1929 already by a long shot; how is it that people, especially “experts”, do not see what’s right in front of their faces?

America has been in a Depression since 2020. A Recession since 2008 that was papered over with Quantitative Easing & artificially low Intrest Rates.

-Dillon Critique from; what’s THE DILL? (Substack)

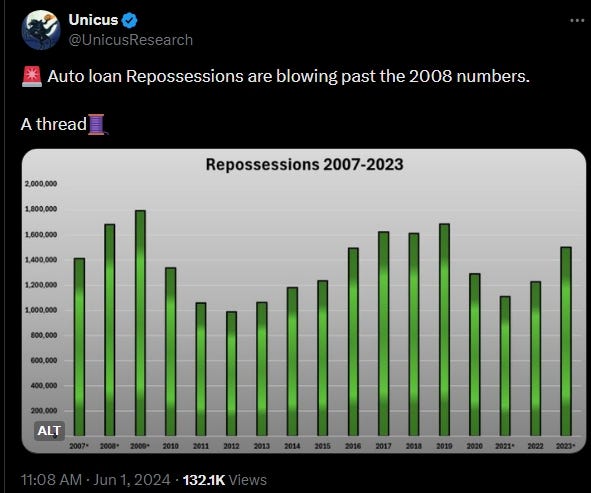

Auto loan Repossessions are blowing past the 2008 numbers

How can we be entering a Recession, when we never recovered from the 2008 recession and the data is worse than the depression of 1929? This makes no logical or rational sense ‘Prima facie’. We can also see the international shift of this reality, that has now transcended the domestic.

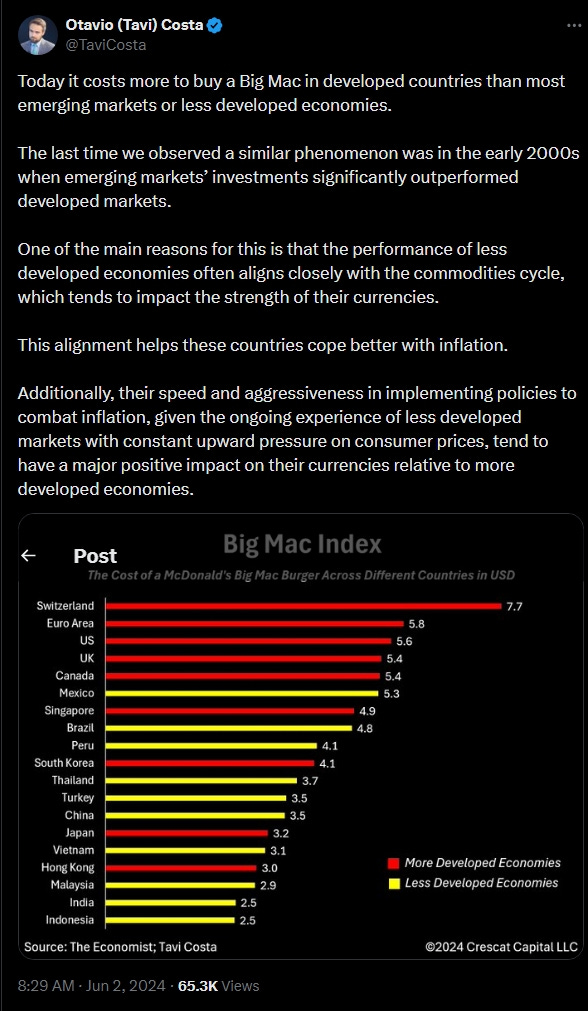

Big Mac now pricier in developed nations; emerging markets thrive, benefiting from strong commodity cycles

When Americans can no longer afford McDonald’s and consider fast food a luxury; you are well past a Recession.

Depressing number of Americans now consider fast food a luxury

Over 50 percent Americans can't afford to buy a simple meal at fast food chains

Young children's parents, Gen Zers and women now think of fast food as luxury

Once considered an American staple, fast food items have now turned into a luxury with a majority of people saying they can no longer afford to buy the quick meals.

A new LendingTree survey shows that due to rampant inflation, 62 percent of the people surveyed say they are barely eating at fast food chain restaurants.

Notably, about 78 percent of consumers now view fast food as a luxury - especially those who are less than $30,000 a year, parents with young children, Gen Zers and women.

Depressing number of Americans now consider fast food a luxury (msn.com)

McDonald's Franchisees Say They Can't Afford The Chain's $5 Meal Deal

Story by Bruce Crumley

An advocacy group for franchise owner-operators says the company should provide financial support when it launches a deeply discounted promotion to woo back inflation-battered consumers.

McDonald's $5 value menu, expected to launch in late June, represents management's hopes that the offer will reinvigorate declining traffic among inflation-battered customers. But the Golden Arches has already gotten a response to the deal it probably didn't expect: an association of restaurant franchisees wants the company to underwrite the cost of the discount to maintain their own profits.

McDonald's Franchisees Say They Can't Afford The Chain's $5 Meal Deal (msn.com)

During The Great Depression They Were Called “Hoovervilles”, But Today America’s Shantytowns Are Called “Bidenvilles”

The man that shot the video, Michael Oxford, used the term “absolute squalor” to describe the conditions that he witnessed…

To those at the bottom of America’s economic pyramid, it feels like the economy has already collapsed. When you can’t afford to put a roof over your head and you barely have enough food to eat, nothing else really matters. During the Great Depression of the 1930s, millions of homeless Americans created large shantytowns known as “Hoovervilles” all over America. Unfortunately, we are witnessing the same thing today. Our homeless population is rapidly exploding, and those that have nowhere to live are creating shelters for themselves out of wood, cardboard boxes, tents, tarps, construction materials and whatever else they can find. In some cases, very large shantytown communities are being established, and they are primarily populated by our young adults…

During the Great Depression (1929 to 1933), 48 percent of the nation was homeless, living with relatives or in “shantytowns,” “Hoovervilles.” Today, between 47 and 52 percent of young adults are homeless, living with parents or shelters, a direct result of Biden’s radical overspending, energy and immigration policies, inflation, and high interest, turning America into a giant “Bidenville.”

During The Great Depression They Were Called “Hoovervilles”, But Today America’s Shantytowns Are Called “Bidenvilles” (citizenwatchreport.com)

When you have “Shotgun” Houses/Shacks (aka Economic Depression Homes) being built by people because they can no longer afford homes; you are not entering a recession or are in one. Again, you are well past a recession. America has already collapsed. The problem is people just haven’t figured it out yet. That’s changing rapidly.

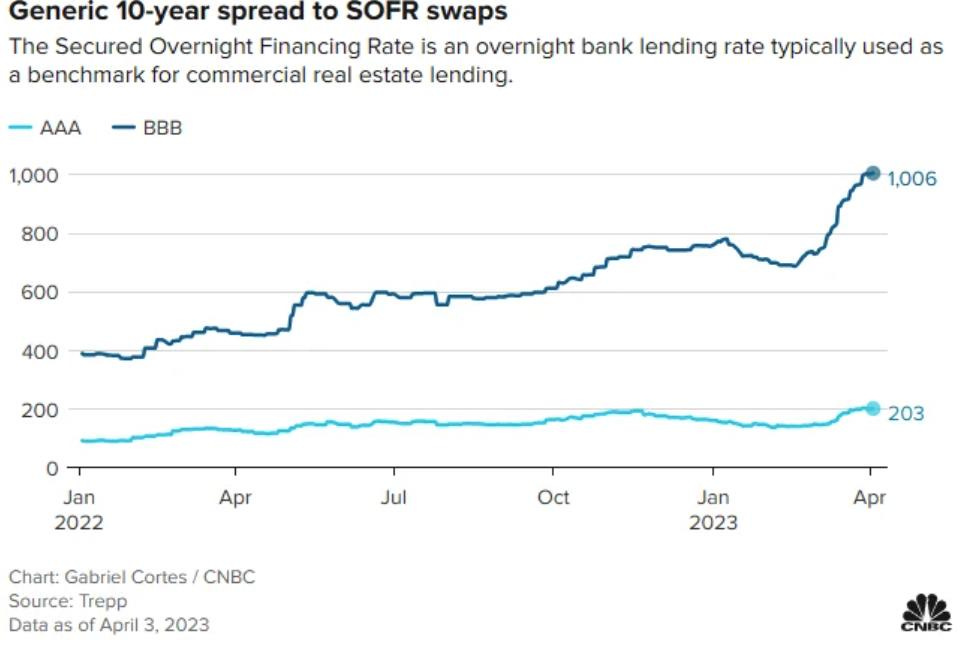

When Americans can no longer afford homes and have also given up on the dream of owning a home; you are not entering a recession or are in one. You are PAST Recession.

Americans Can No Longer Afford Homes

Key facts about housing affordability in the U.S.

A rising share of Americans say the availability of affordable housing is a major problem in their local community. In October 2021, about half of Americans (49%) said this was a major problem where they live, up 10 percentage points from early 2018. In the same 2021 survey, 70% of Americans said young adults today have a harder time buying a home than their parents’ generation did.

Housing affordability in the U.S.: Key facts | Pew Research Center

For most Americans, owning a home is now a distant dream

"Unfortunately, the middle-class dream of homeownership has been fading away," Redfin chief economist Daryl Fairweather told CBS MoneyWatch. Owning a home in the U.S., she said, "is a signifier of the upper class now."

For most Americans, owning a home is now a distant dream - CBS News

Housing is now unaffordable for a record half of all U.S. renters, study finds

By Jennifer Ludden

As the Harvard report notes, U.S. homelessness rates hit a record high last year.

Over the past two years, Genuine Campbell was shocked at how rent for her two-bedroom apartment in Philadelphia just kept going up — from $1,300 a month to $1,600. She's a single mom of four, and right as her rent was rising, her hours as a hotel valet were getting cut.

Add in utility costs plus inflation, and every month brought a wrenching decision.

"Do you want to pay the bills and then give half the rent, or do you want to try to do the whole rent and then be back on bills?" she says.

Housing is unaffordable for a record half of all U.S. renters : NPR

When Americans can no longer afford Homes and Homelessness hits an new all time record high, you are not entering a recession or are in one. You are well past Recession.

Homelessness in the U.S. hit a record high last year as pandemic aid ran out

by Jennifer Ludden

Homelessness in America spiked last year, reaching a record high, according to an annual count that provides a snapshot of one night in January. The report, released today by the department of Housing and Urban development, found more than 650,000 people were living in shelters or outside in tents or cars. That's up a whopping 12% from the year before.

To advocates, it hardly comes as a surprise.

"We simply don't have enough homes that people can afford," says Jeff Olivet, executive director of the U.S. Interagency Council on Homelessness. "When you combine rapidly rising rent, that it just costs more per month for people to get into a place and keep a place, you get this vicious game of musical chairs."

Homelessness in the U.S. hit a record high last year : NPR

When the majority of the homeless population work one or more jobs and are still homeless, you are not entering a recession or are in one. You are well past Recession. You’re in a Depression and your currency has collapsed. It just psychologically hasn’t been figured out yet but is starting to weigh very heavily on nearly everyone. The public stress levels are palpable.

40 to 60 percent of the homeless work, and yet just cannot make it. That is a crisis

by AMAC, Robert B. Charles

During the Great Depression (1929 to 1933), 48 percent of the nation was homeless, living with relatives or in “shantytowns,” “Hoovervilles.” Today, between 47 and 52 percent of young adults are homeless, living with parents or shelters, a direct result of Biden’s radical overspending, energy and immigration policies, inflation, and high interest, turning America into a giant “Bidenville.”

Hooverville to Bidenville – Unaffordable Housing Crisis (amac.us)

Homelessness Data & Trends | United States Interagency Council on Homelessness (usich.gov)

Housing affordability in the U.S.: Key facts | Pew Research Center

It is indeed a crisis. More specifically, “The New Greater American Depression”; than that of 1929.

The government knows the economy and currency are collapsing. Hence why they lie about the economy/data and Universal Basic Income is attempted at being rolled out as their solution. UBI is coupled with the new CBDC (Central Bank Digital Currency) system.

The government knows most people will be needing money handouts and food rations in the near future. This is them planning ahead for the chaos they themselves have sowed by use of the Hegelian Dialectic, Problem, Reaction and Solution. However, some states are culling the initial UBI pilot program.

States Are Banning Guaranteed Income Programs (Universal Basic Income Pilot Program)

Four states now have laws in place that prevent cities and counties from creating or continuing guaranteed income programs, and several more have tried or are trying.

“After years of momentum behind guaranteed income programs that disburse no-strings-attached cash, the backlash has arrived in force,” writes Sarah Holder in an article for Bloomberg.

More than 100 pilots have been launched in cities and counties across the United States since 2018. But this legislative session, lawmakers in South Dakota, Idaho, and Iowa passed legislation barring state and local governments from making guaranteed income payments. At least another seven other states have tried or are trying: Arkansas successfully banned localities from creating universal basic incomes in 2023; Arizona, Wisconsin, and Mississippi tried to pass similar legislation this year but failed; West Virginia has introduced a bill this year that has not yet come up for vote. Texas Attorney General Ken Paxon has also sued Harris County, which includes Houson, over its just-launched pilot, Holder reports.

Guaranteed income programs “distribute money at regular intervals to specific populations in need, like low-income residents, or new mothers or homeless youth. Unlike other social safety net programs, they don’t typically ask recipients to meet any conditions in exchange for the money or use it in particular ways.

States Are Banning Guaranteed Income Programs (Universal Basic Income Pilot Program) (citizenwatchreport.com)

https://www.planetizen.com/news/2024/05/129183-states-are-banning-guaranteed-income-programs

The dollar is so worthless now that massive amounts of funny money no longer has an effect. The USD has already collapsed. Hence why Central Banks are hoarding gold at never before seen levels and the US governments UBI & CBDC as a “Solution”.

Global central banks are hoarding gold like never before as they seek to reduce 'overconcentration' of dollar reserves

“Overconcentration” is code word for ‘worthless holdings of dollar reserves’.

De-Dollarization: Global Central Banks Are Hoarding Gold Like Never Before - Markets Insider (businessinsider.com)

Despite 3 trillion dollars of deficit spending, GDP is barely positive

By Brittany De Lea 2020

The Congressional Budget Office estimated in an updated report released on Wednesday that the federal budget deficit could hit $3.3 trillion this year, which would triple the deficit recorded last year.

The forecast represents 16% of gross domestic product – which would be the largest deficit recorded since World War II.

As a result, federal debt held by the public this year could increase to 98% of GDP.

US deficit could hit $3.3T in 2020, amplified by coronavirus relief spending: CBO | Fox Business

Your UBI/CBDC, Vaccination Status and Food Rations will possibly located and or tied to the following type of technology…

REAL ID | Homeland Security (dhs.gov)

It should be noted that this REAL ID tech is being pre-conditioned and pre-programmed on the public through AIR TRAVEL, which will then extend to everyday life eventually. Don’t be a fool and believe when they tell you this is for air travel only. They intended the fully digital slave system to be enacted during Covid, but failed.

Here is the public deadline they missed and state as such:

Secretary of Homeland Security Alejandro N. Mayorkas announced the Department of Homeland Security (DHS) is extending the REAL ID full enforcement date by 19 months, from October 1, 2021 to May 3, 2023, due to circumstances resulting from the ongoing COVID-19 pandemic.

DHS Announces Extension of REAL ID Full Enforcement Deadline | Homeland Security

Economy Already Dead

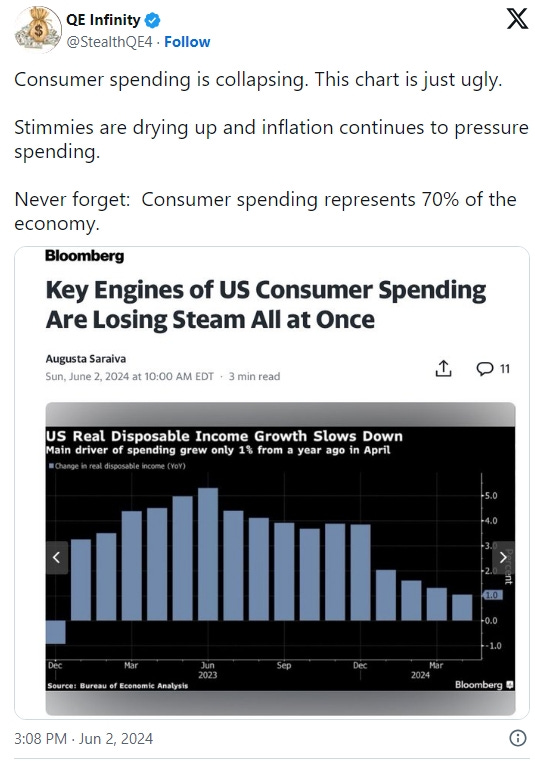

If 70% of our economy is based on and upheld by consumer spending and the majority of consumers now have nothing to spend, does it not stand to reason the economy is already dead? That is why we are seeing a long term negative consistent trend downward.

For this trend to reverse, it isn’t enough to simply create currency anymore because the currency no longer has or holds any value. We went over this earlier in the beginning of the aritcle. Funny money in mass no longer working.

So, for this trend to reverse, there needs to be value added back to the Dollar (or a whole new system aka CBDC), those dollars then need to find their way into the general public’s hands to then spend. On top of that, currency devaluation/over spending by the Federal Reserve and Gov must stop simultaneously.

The pre-planned solution to the pre-planned global and domestic economic collapse the globalist have induced, is Depopulation of the Public. That was the purpose of the Covid Vaccines. The Philippines is a microcosm of what’s happening globally.

Philippines – Hundreds of thousands of excess deaths and a birth rate going off a cliff – a MILLION fewer babies born

MUST WATCH: Explosive findings have been revealed in a recent Philippine House of Representatives committee investigation into hundreds of thousands of excess deaths believed to be linked to the COVID-19 vaccines. The committee heard that not only have there been hundreds of thousands of excess deaths since the COVID-19 vaccine rollout, but there has also been a decline of nearly one million births in the country.

-The Canadian Independent

VIDEO: The Canadian Independent

Sources:

TRACKER: The Philippines’ COVID-19 vaccine distribution (rappler.com)

Philippines – Hundreds of thousands of excess deaths and a birth rate going off a cliff – a MILLION fewer babies born (citizenwatchreport.com)

YOU ARE THE CARBON FOOTPRINT THEY WANT TO GET RID OF!!!

CHICAGO PMI COLLAPSES

Closing in on 2008 recession levels rapidly but will exceed said 2008 levels. The difference between 2008 and 2024 are horrifically substantial. The proverbial party is just getting started.

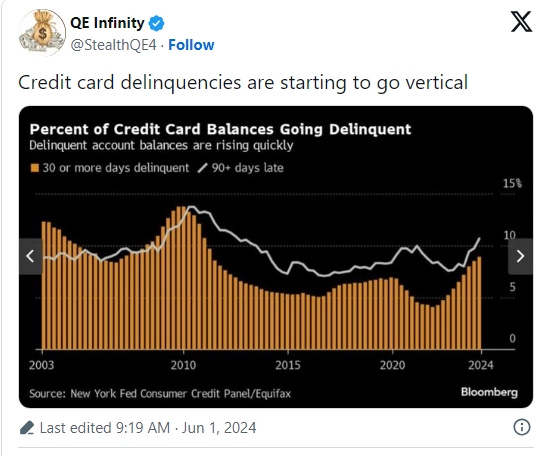

As the Collapse/Depression worsens, people are relying on bank credit to SURVIVE, not just live, which they can’t pay back as wages also continue to stagnate. Showing that the house of cards is falling and coming full circle. A Doom Loop.

Banks are extending credit as it is the only thing keeping everything from falling apart. Eventually this will fail and the ensuing chaos will be incomprehensible to the majority of people unless you are aware of Wiemar Germany, Venezuela, Zimbabwe etc.

If credit wasn’t extended, that uptrend in the chart below, would be downward

Preaching to the choir, friend. I've been watching this shit for a very long time. Still, keep it up. The word needs to get out to wake people up.

Thank you.