Saturday September 7 2024

by Dillon Critique from; (substack)

The U.S. has been in a Recession since 2007-2008 that was papered over by Quantitative Easing & artificially suppressed interest rates.

A Hyperinflationary Depression since 2020. Hence why 80% of all US currency to ever exist, was created in just 22 months (January 2020 - October 2021) and failed to “stimulate growth”, in anyway.

Let's look at the M2 Supply chart below…

https://techstartups.com/2021/12/18/80-us-dollars-existence-printed-january-2020-october-2021/

M2 supply Chart:

Notice the long “ramping up pattern” just before the parabolic straight shot up.

There is possibly another big long trajectory upwards as we go further into Hyperinflation by way of; rates being above 0% in combination with continued QE to support markets (doesn’t mean markets go up) and unfunded liabilites like social security etc. until; we transition to the new digital crypto monetary surveillance slavery system economy.

As M2 supply shot up vertically (chart above);

not long after, (lag time) you can see M2 velocity sky rocket (chart below) through the roof as well, from an all time bottom.

That all time bottom, was just that. A record breaking all time historical low in American history, for m2 velocity.

It also should be noted that, with the lowest recorded M2 velocity on record, the US also had at the same time, the highest record inflation that year. The next year (2021) and every year after now obviously (2023 -2024……). Everyone is more than aware by now of that and feeling the pain by this point of a hyperinflating currency.

Interest Rates

do not matter when your currency (USD) has already died (negative purchasing power) and or is also hyperinflating. Rates are irrelevant at that/this point and stage in the game and mean nothing.

It is the equivalent of missing an arm or leg and bleeding out, but all you're worried about and fixated on is tying your shoes (rates).

People are to hyper-focused or fixated and not looking at the bigger picture. Everyone's obsessed with trying to figure what the Fed is going to do with rates or everyone is betting on the usual playbook/business as usual of, “waiting for rate cuts”. Instead of soaking in what's already around them. It's like a state of blind shock that has yet been realized and the conscious mind has not snapped back to reality.

I believe this complacency and repetitiveness of the last 16 years is a stale stagnate view of the current situation. It's to easy (expecting rate cuts) and appears to be a set up. The game isn't the same and has changed. People just haven't figured it out yet or see it. Everybody can feel it though, in their gut and spirit.

The Fed could be signaling rate cuts (Jacksonhole Meeting) to suck money into markets and make everyone position themselves as if rate cuts are coming, when they won't be. A psychological operation. A head fake. They could sucker people with a .25 cut to get the psychological ball rolling. Is this a rug pull or the setup for one? Let me know what you think in the town hall (comment section) below…

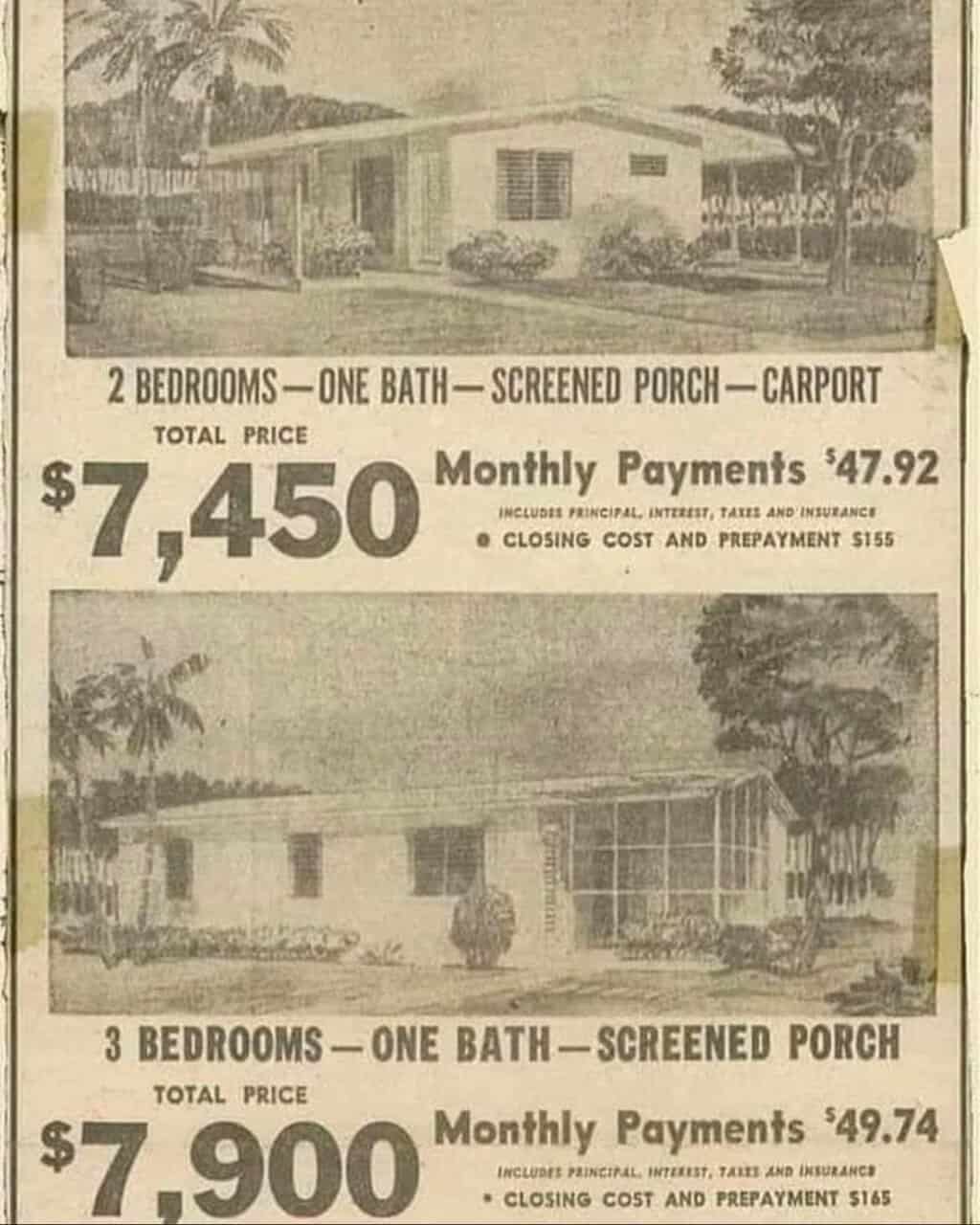

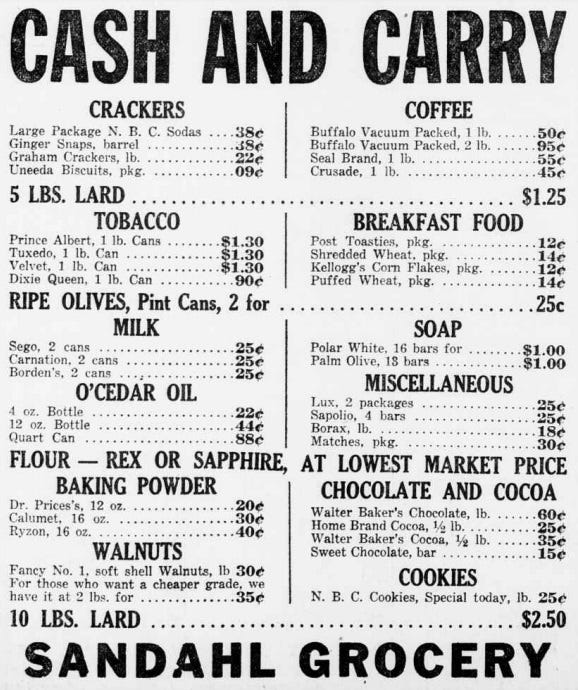

Compare prices from “back in the day” below, to prices today.

Chart doesn't show last four years of devaluation

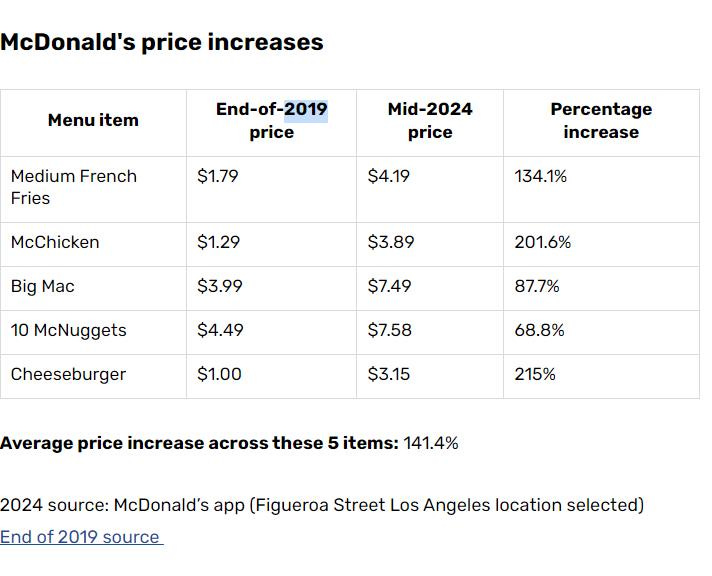

Look at these McDonalds increases over the last several years alone. Has anyone seen their wages increase by this much in this short amount of time?

We've already been in and are in Hyperinflation

In 1970, the average salary was about $10,000.

Gold was about $40 an ounce. At a salary of $10,000, you could buy 250 oz of Gold.

In 1970, a man could support a family of four or five. A wife who didn't have to work, kids, a house and vehicle.

Today (2024), the average salary is $40,000. Gold is about $2350 an oz.

At a salary of $40,000, you can only buy 17 oz of Gold. While 250 oz of Gold, is now well over $500,000 in today’s purchasing power vs the $10,000 for 250 oz, in 1970.

Today’s $40,000 salary isn't even enough to survive on anymore in the majority of America.

A house in 1952 averaged around $9,000-$7,000. Today house average is $500,000. That's Hyperinflation.

Having a discussion with an economic YouTuber, they stated to me; ‘we cannot possibly be in Hyperinflation because there are 3 commodities most vital to man sitting 50% below their all time highs’. This is a great point however, I responded;

Three commodities sitting below 50% is irrelevant to hyperinflation. Those commodities are also manipulated, which means they should technically be well over 50%, like the majority of all other prices. Three commodities sitting below 50%, doesn't mean you're not hyperinflating or have not already entered Hyperinflation. Three commodities being below 50%, is not the standard by which hyperinflation is measured.

The textbook agreed upon value of 50% for Hyperinflation; is nothing more than an irrelevant arbitrary subjective value that was simply agreed upon by a consensus of academics, to use as a baseline. Anything below 50%, doesn't mean you're not already hyperinflating or beginning to. Some prices below 50% also do not mean you're not already in Hyperinflation.

-Dillon Critique from;

(substack)

I believe the Fed will not be going back to 0%, although they could obviously. They raised rates on purpose to begin collpasing the system and cause an imbalance/instability. To continue to Hyperinflate the dollar with raised rates and continued QE.

Why?

(1); To transition power from west to east (New World Order). (2); To collpase the current system/west and move to the new CBDC/Crypto digital slavery surveillance system economy.

This is why Trump and Kamala (undercover Globalist) are right on que pushing Bitcoin/crypto currency on the public.

https://www.independent.co.uk/news/world/americas/us-politics/trump-cryptocurrency-world-liberty-financial-b2608885.html

https://www.bloomberg.com/news/articles/2024-08-21/harris-supports-policies-to-expand-crypto-industry-aide-says

This is Social Engineering at it's finest. This is the Hegelian Dialetic at it's finest. We are very close to a transition when you see the Globalists beginning to pre pre-program and pre-condition the general public with their puppets like this.

Digressing…

Slight swings up and down in rates are irrelevant. They will be used for show, for psychological purposes. To steer the markets perception and markets themselves. To sucker people in.

These slight swings I would consider to NOT be an actual qualifying rate cut because 0% has been our baseline for the last 16 years or so. To cut rates, we would need to see negative territory, something below zero. Slight swings/manipulations of rates up and down by the Fed, either by rhetoric or by buying the debt, is irrelevant and is nothing more than a psychological distraction.

On the other hand, one could argue we are at negative rates already with inflation as high as it is and yields as low as they are.

A negative real interest rate; occurs when the inflation rate is higher than the nominal interest rate.

You know you're in a Hyperinflationary Depression when…

The USD purchasing power is negative. That's why Americans rely on credit cards to LITERALLY SURVIVE.

https://www.cnet.com/personal-finance/credit-cards/features/maxed-out-inside-americas-credit-card-debt-crisis-and-what-we-do-next/

…Fast food is now considered a luxury for the majority of households.

https://www.newsweek.com/how-fast-food-became-luxury-1906677#:~:text=A%20recent%20survey%20by%20LendingTree,less%20often%20as%20a%20result.&text=Of%20the%202%2C000%20adults%20who,because%20they're%20struggling%20financially

…People are cutting back further on food purchases to afford electricity.

https://finance.yahoo.com/news/americans-cutting-back-groceries-pay-213950226.html

…Food banks across America are running out of food as record demand increases.

America and the US dollar has already collapsed. People just haven't figured it out yet. The above should make it obvious.

Higher Markets are Irrelevant

Venezuela had the best performing stock market in the world for years, while starvation and worthless currency literally litered the streets.

Venezuela was best performing stock market in the world for years while collapsing.

https://www.schiffsovereign.com/stocks/and-the-best-performing-stock-market-in-the-world-is-21875/

(Imagine credit: Miguel Gutierrez for THE WALL STREET JOURNAL)

At this point, rates do not matter. Higher markets do not matter.

The USD has ALREADY collpased and HAS BEEN hyperinflating. We won't look like Venezuela overnight. The country has already collpased, people just haven't figured it out yet.

-Dillon Critique from

(substack)https://www.blackboxpolitics.substack.com

Great article, most people have no idea what is coming. It is all a script that leads to digital money, social credit system and some sort of basic income. It am not going to say that it will lead to a new world order because it will just be a different version of the world order we have today.

It is all a big show, almost everything is fake except the deaths from gullible, law-abiding, tax-paying, voting citizens that poison themselves into an early grave.

Excellent points with evidence to back it up. The fed can "tighten" and "ease" at the same time and we'll just call it "yield curve control" and pretend we have a free market. Bananas!