by Dillon Critique from; what's the DILL?

May 11, 2024 SATURDAY

Share this with others to get the word out!

The Federal Reserve Raised Rates on Purpose, to Begin Collapsing the System.

To transition to the new digital monetary system, fall of the West & rise of the East.

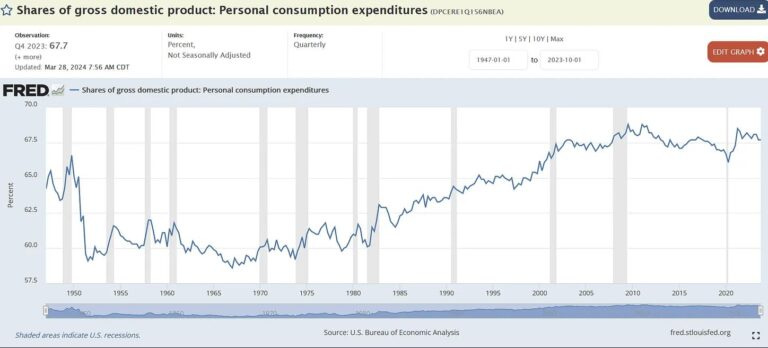

Amerika has been in a recession since 2008 that was papered over by QE. The Greater Depression began in 2020-2021. Hyperinflation has also already been in process.

These Are The Birth Pangs

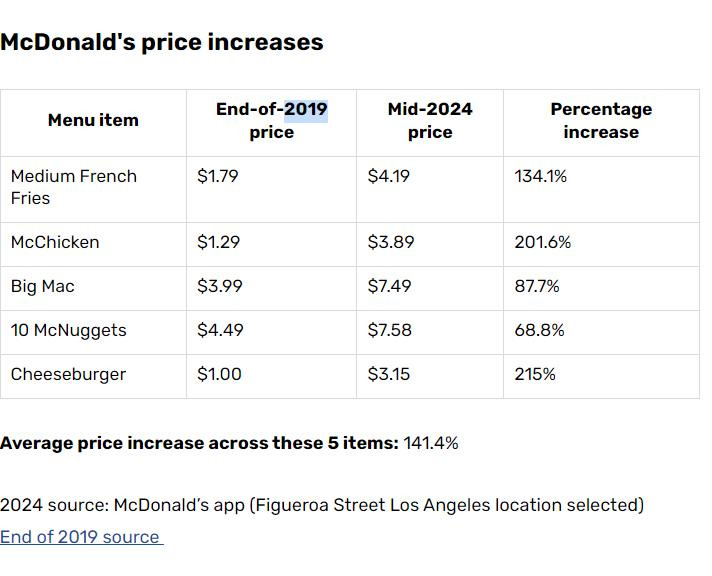

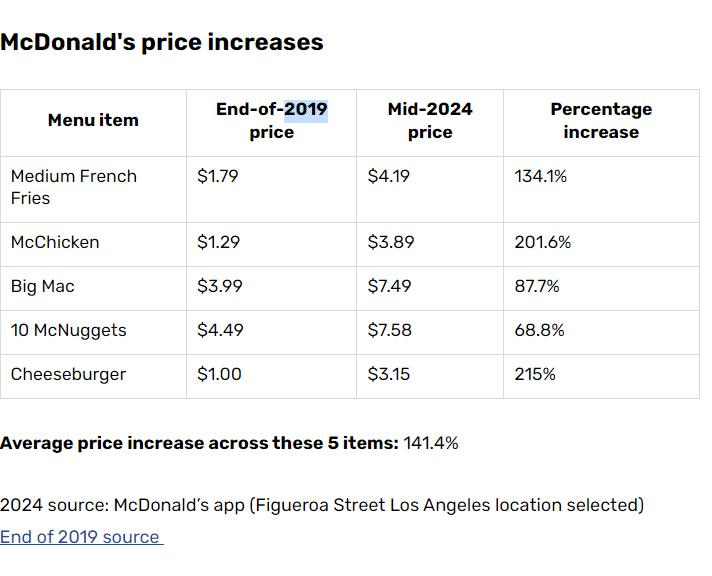

What a Hyperinflationary Depression looks like at McDonald's.

Chapter 11 bankruptcy filings continue trending up (Factset)

In 2023, Chapter 11 bankruptcy filings skyrocketed by 72%, reaching a total of 6,569, as revealed by data from Epiq AACER. The surge, attributed to rising interest rates and inflation, pushed highly leveraged organizations to the brink. Additionally, Subchapter V elections within Chapter 11, aimed at small businesses, surged by 45% to 1,939 filings.

Sources:

https://www.cfo.com/news/chapter-11-bankruptcy-reorganization-2023-Epiq-subchapter-V-healthcare-Peloton-effect/704173/

www.uscourts.gov/statistics-reports/analysis-reports/bankruptcy-filings-statistics/bankruptcy-statistics-data

https://citizenwatchreport.com/chapter-11-bankruptcy-filings-continue-trending-up-factset/#google_vignette

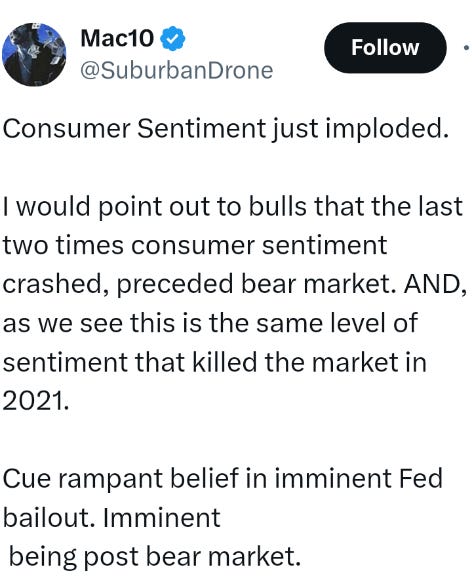

Consumer Sentiment just imploded

Consumer sentiment has plummeted, mirroring levels seen before previous bear markets, including the market slump in 2021. This downturn, coupled with record-high US credit card delinquency rates in Q4 2023, with nearly 3.5% of card balances over 30 days past due, signals potential financial turmoil. Moreover, serious delinquency rates (90+ days) are rising at the fastest pace since the Great Financial Crisis. Adding to the economic concerns, the impending “phantom debt” crisis looms large, driven by future installment payments from ‘buy now, pay later’ programs, posing a significant threat to already indebted Americans.

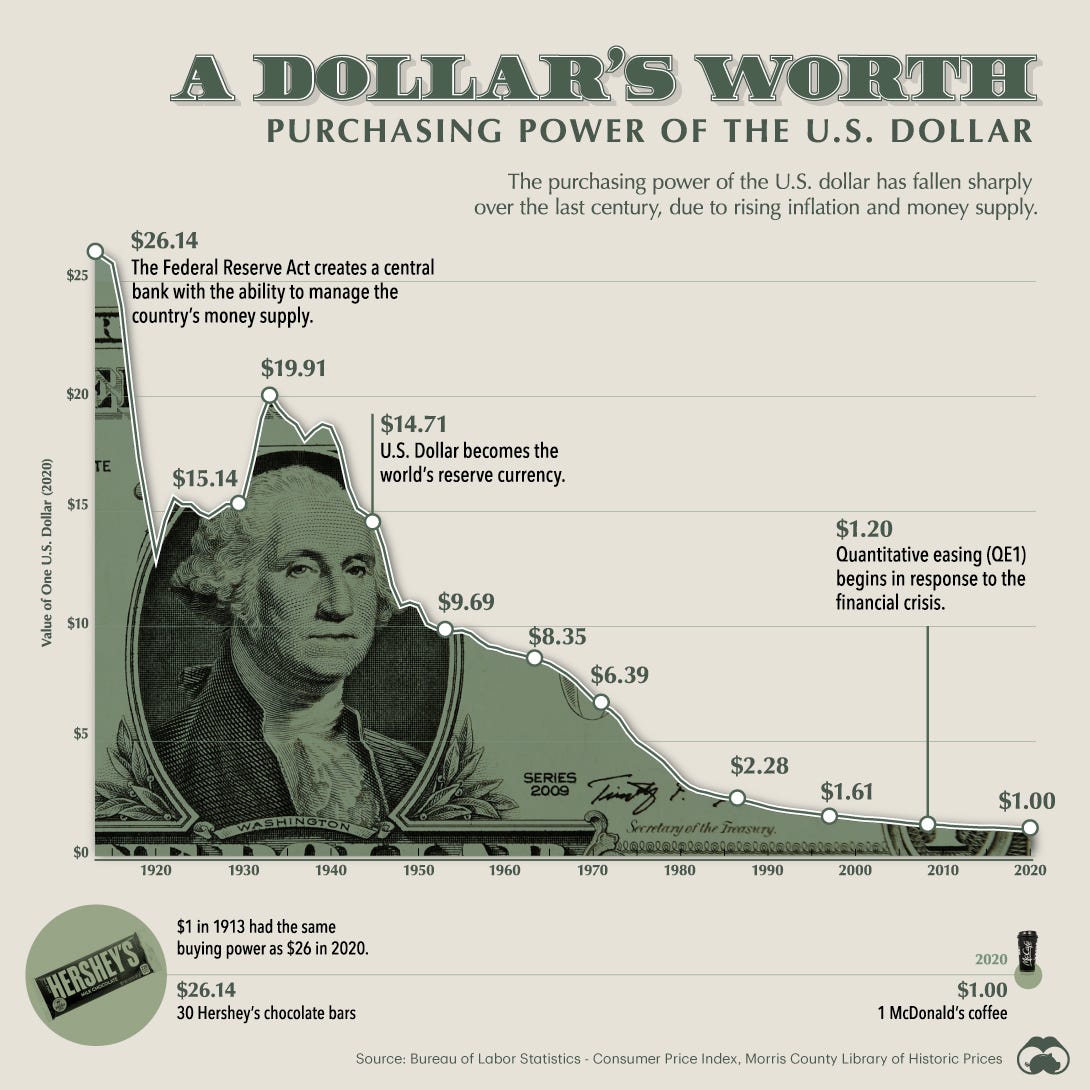

The USD has Already Collapsed

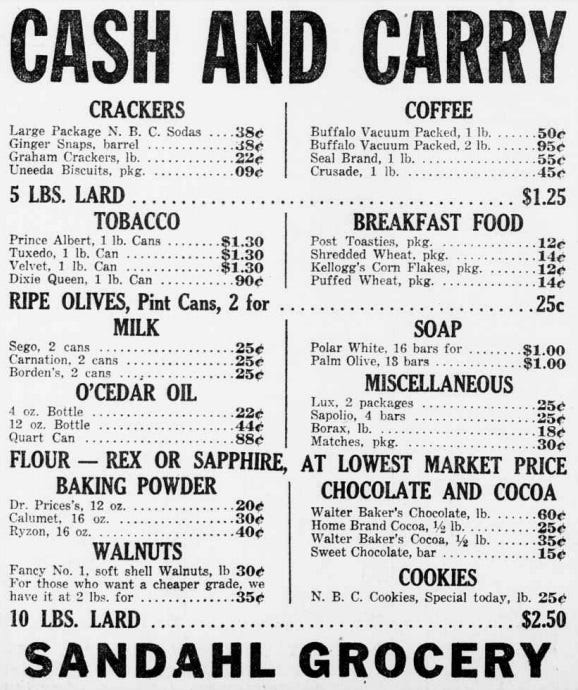

The USD has already collapsed, as the purchasing power is negative.

As admitted by the Federal Reserve’s own website (Federal Reserve Education Department), the Federal Reserve Note has lost 98% of it's value since 1913. That means there is $0.03 left out of the original $1.00.

That's the public admission, so we know it's much, much worse. Why? Because the Fed wouldn't tell the population the truth. The Fed has a vested interest in lying.

How do the Central Bankers tell the population they are working for negative wages? Simple. Don't tell them and let them suffer.

The price of a McDonalds Cheese burger has increased a modest (Tounge in cheek) 219% since 2019 alone.

Prices from the 1920’s

Because the purchasing power of the Dollar is negative, the public and Government has entered the spiral of………

The Bottomless Pit

Of Debt

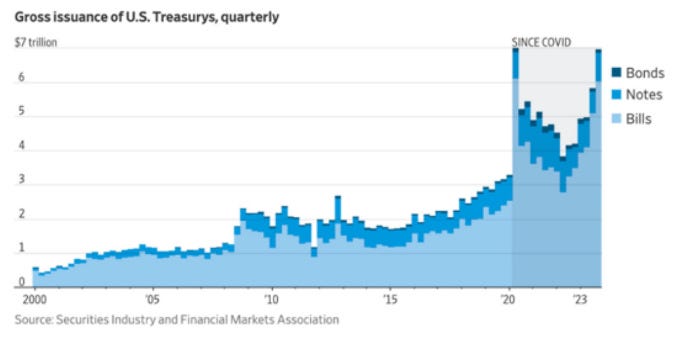

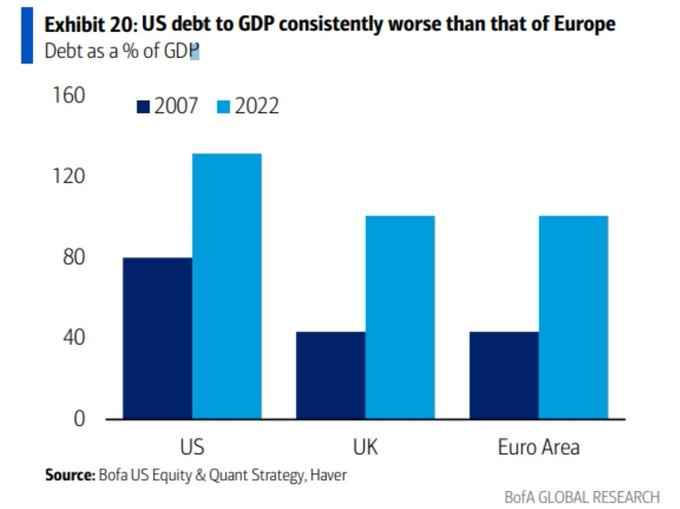

Its not just the citizens trying to stay afloat with debt. So is the Government.

US Federal Debt Skyrockets: $100,000 Added Every Second

US piling on a staggering $10 billion in debt per day. The numbers are dizzying: $417 million every hour, $6.9 million every minute, and a jaw-dropping $115,740 every second.

https://citizenwatchreport.com/us-federal-debt-skyrockets-100000-added-every-second/#google_vignette

US interest payments reached more than $1 trillion in 2023 for the first time in history. Interest costs account for more than 36% of government receipts, the most in 27 yrs. They are set to reach a WHOPPING $1.6T by the end of 2024, if rates remain steady.

US Treasury’s $2 million per minute borrowing spree raises alarm; BlackRock issues urgent warning on US dollar stability.

They have added over 50% to the money supply over the last decade. More than 40% of that comes from the Biden Administration. They're getting ready to issue 10 TRILLION more in debt.

Did you hear that or comprehend that? Ten Trillion more, on top of the tens of trillions in debt, we already are. Tens of trillions. Let that sink in. When you have tens of trillions in debt, it's safe to assume you've already collapsed and can't pay such a bill. Duh right?

How Much More Clear Can The Collpase Be?

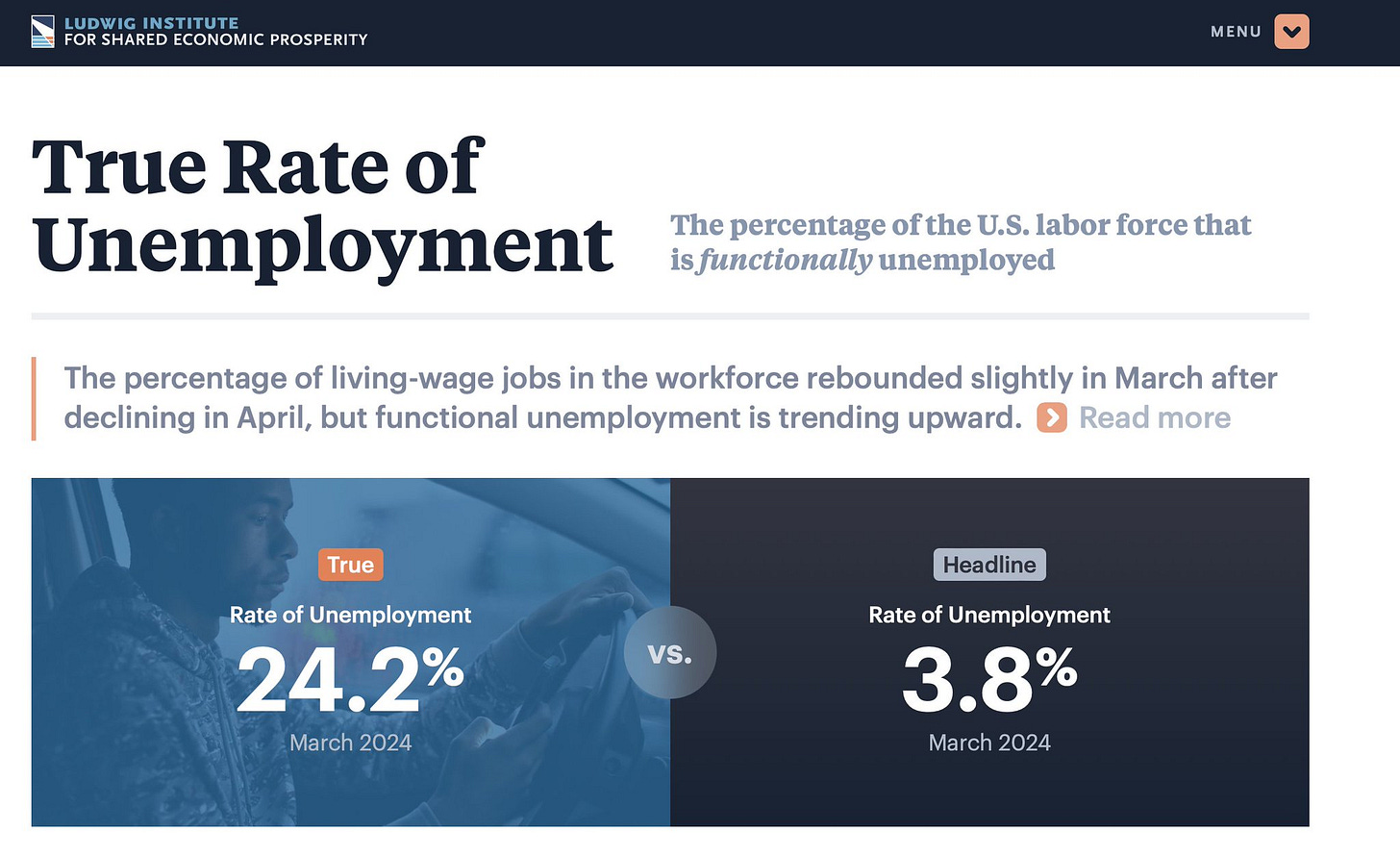

The True Rate of Unemployment is 24.2% according to the Ludwig Institute

Based on data from the BLS, it measures the percentage of the US labor force lacking full-time employment (35+ hours a week), seeking work, or earning below $25,000 annually before taxes.

From a previous Forbes article, going back 4 years, quote:

“It is estimated that unemployment hit 24.9% during the Great Depression.”

April’s employment report set records for all the wrong reasons. The unemployment rate increased from 4.4% to 14.7%, the largest one month increase in history and the highest rate in the history of official government data (started in 1948). It is estimated that unemployment hit 24.9% during the Great Depression.

Employment dropped by 20.5 million, more than 10 times the previous largest monthly decrease of 1.96 million experienced in September 1945 after World War II ended. At that point in time this was about 3.3% of the workforce.

www.forbes.com/sites/chuckjones/2020/05/19/3-reasons-unemployment-is-already-at-great-depression-levels/?sh=55d248f413f1

Again, The true Rate of Unemployment is 24.2% according to the Ludwig Institute and unemployment was 24.9 during the Great Depression.

Tesla, Citigroup, and Dell cut 50,000 jobs combined

Tesla, Citigroup, and Dell have collectively cut 50,000 jobs, while trucking giant Yellow, with 12,000 trucks, has collapsed. This trend suggests a significant deterioration in employment, as historically, whenever unemployment rates exceed the 2-year moving average, a rapid increase in unemployment follows.

Unemployment builds slowly at first and then rapidly. Every time unemployment rates are greater than the 2y MA, a significant deterioration has followed.

An Enormous Chunk Of The U.S. Population Is Either Homeless, Living In Poverty Or Considered To Be Among The Working Poor

According to a report from Harvard University, approximately 650,000 Americans were homeless at some point last year. That represented an increase of nearly 50 percent from 2015.

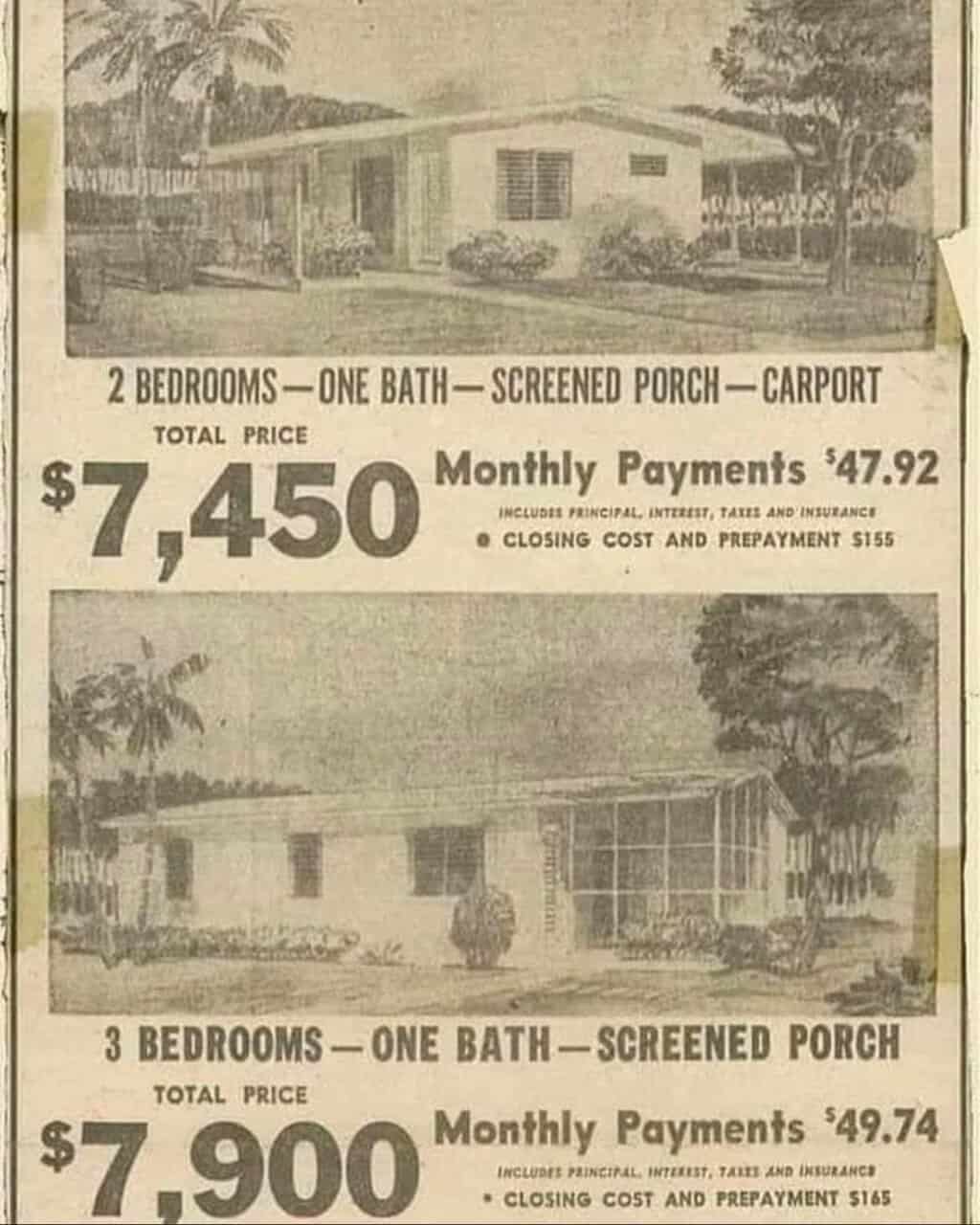

Costs of renting and home ownership have skyrocketed while wages largely stagnate. The Harvard report found that half of U.S. households are “cost-burdened” (meaning that 30-50% of monthly income goes to housing), and 12 million people are “severely cost-burdened.” These Americans stand one accident, health setback, or employment disruption away from eviction.

https://citizenwatchreport.com/an-enormous-chunk-of-the-u-s-population-is-either-homeless-living-in-poverty-or-considered-to-be-among-the-working-poor/#google_vignette

San Francisco homelessness: Number of families seeking shelter grows

sfstandard.com/2024/05/01/homeless-families-shelter-waitlist-migrant-surge/

‘Not sustainable’: DFW food banks struggle to meet surging need, even as their resources decline

https://www.keranews.org/business-economy/2023-04-21/not-sustainable-dfw-food-banks-struggle-to-meet-surging-need-even-as-their-resources-decline

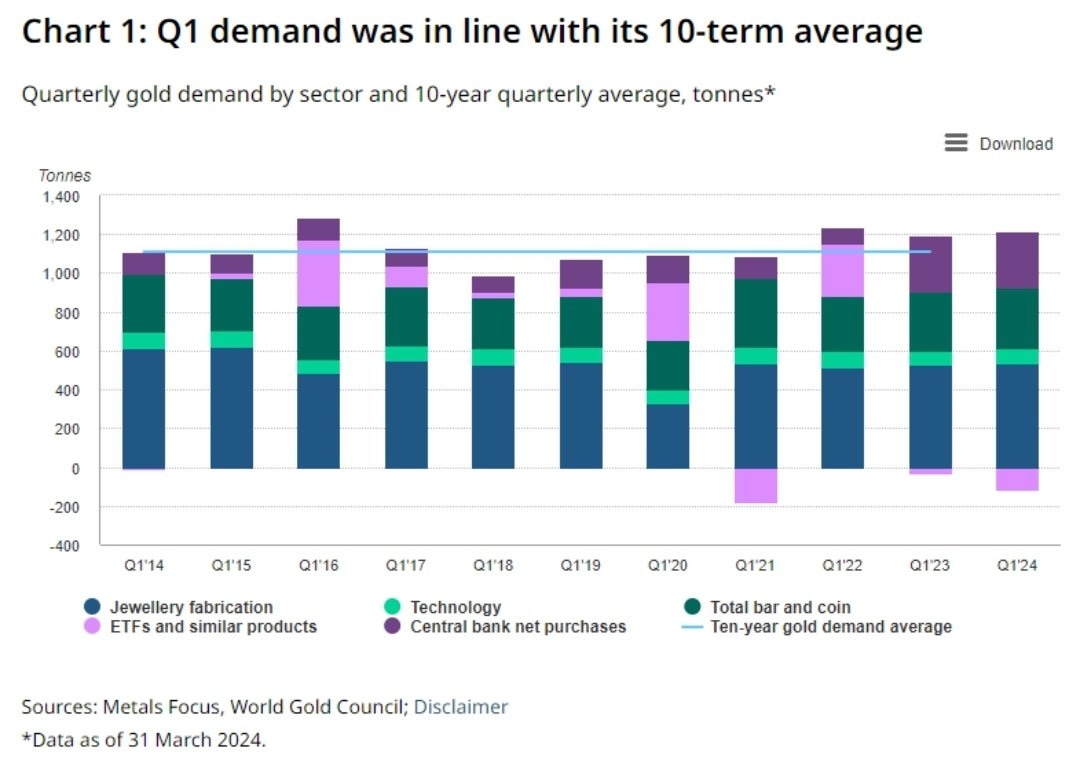

Global Central Banks know what's coming

Or rather, what's already here. That's why they are hoarding Gold at never before seen levels.

Central banks’ record gold purchases drive strongest first quarter demand in 8 years

https://www.marketwatch.com/story/why-global-gold-demand-marked-its-best-first-quarter-in-8-years-86c0f0df

Global central banks are hoarding gold like never before as they seek to reduce 'over concentration' of dollar reserves

https://markets.businessinsider.com/news/commodities/de-dollarization-global-central-banks-are-hoarding-gold-like-never-before-2023-10

Meanwhile,

Get Ready For The New Digital Monetary System Being Rolled out

$267,000,000,000 Bank To Abolish Cash, Warns Customers To Prepare for Massive Digital Overhaul

One of the largest banks in Australia is rolling out a plan to terminate cash and checking services.

In an update on its website, Macquarie Bank, which has $267 billion in assets, tells customers that a digital-centered banking experience will begin in November.

“In case you missed it, we’re phasing out our cash and cheque services for all products. To prepare for this change, you’ll need to start transacting digitally – a safe, quick, and more convenient way to bank. We’re removing our cash and cheque facilities in a phased approach.”

The bank says customers will no longer be able to access a list of over-the-counter services at Macquaries’ physical locations, nor deposit or collect checks or order new checkbooks.

dailyhodl.com/2024/05/10/267000000000-bank-to-abolish-cash-warns-customers-to-prepare-for-massive-digital-overhaul/

The United States has been in a recession since 2008. It was papered over by Quantitative Easing and artificially low interest rates. A depression since 2020.

There's a reason why 41% of all US Dollar ever created, where created in one year.

40% of US dollars in existence were printed in the last 12 months: Is America repeating the same mistake of 1921 Weimar Germany?

https://techstartups.com/2021/05/22/40-us-dollars-existence-printed-last-12-months-america-repeating-mistake-1921-weimar-germany/

Its now worse;

80% of all US dollars in existence were printed in the last 22 months (from $4 trillion in January 2020 to $20 trillion in October 2021) – UPDATED

https://techstartups.com/2021/12/18/80-us-dollars-existence-printed-january-2020-october-2021/

You are living during and in the middle of; the death of the American Empire, fall of the West and rise of the East and a transition to a digital monetary slavery system.

by Dillon Critique from; what's the DILL?: Substack

Click to Fight Back in the Information War! Share This to Get the Word Out! Let Others Know What's Happening & Why!