by Dillon Critique From; (substack)

Monday October 7 2024

“What kind of people a nation is, what level of civilization it has reached, what its social structure looks like, what its politics may prepare for undertakings – this and much more can be found in its financial history, free of clichés. Those who understand its message will hear it more clearly than the thunder of world history anywhere.” -Joseph Alois Schumpeter (February 8, 1883 – January 8, 1950)

Joseph Schumpeter was an Austrian economist and political scientist. Joseph was an important representative of the Austrian School of Economics, and one of the most influential economists of the 20th century.

Let’s Look at America and See What the Message is…

Final Blow-off Top in Progress?

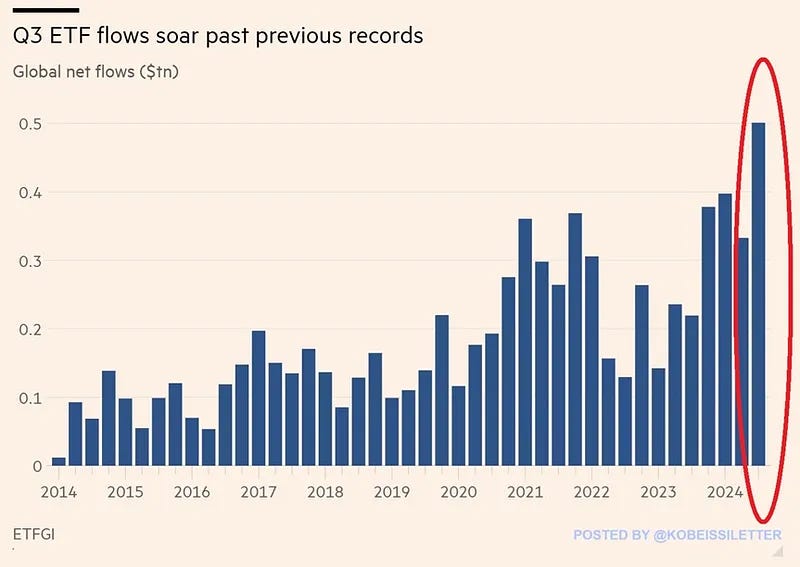

Global ETFs saw $501 billion in net inflows in Q3 2024, the most on record.

Inflows exceeded the previous record of $398 billion in Q1 2024 by 26% and were double the average seen over the last 3 years.

In the first 3 quarters of 2024, net inflows hit a whopping $1.45 trillion, according to ETFGI.

In effect, global ETF assets rose from $11.6 trillion at the end of 2023 to $14.1 trillion in Q3 2024.

Meanwhile, since the 2020 pandemic, global ETF asset values have nearly TRIPLED.

Capital continues to rush into markets at a record pace which is beyond insanity at this point.

Insiders are and have been fleeing/selling their positions, the Fed replaces their positions with the liquidity that was taken away and then some, pumping stocks “higher” sucking retail into the final possible blow-off top with the elites positions closed and covered. This slow transition has been happening for years.

Risk Transfer…

https://www.ft.com/content/3bcc3949-0bf6-4f41-bc46-57cbb0df3a7f

https://www.nasdaq.com/articles/insider-selling-breakneck-pace-should-investors-be-worried

https://www.wsj.com/finance/stocks/stock-market-rally-corporate-insiders-2bb59974?msockid=27aafeb4acbc6afb05caea0cadf56b12

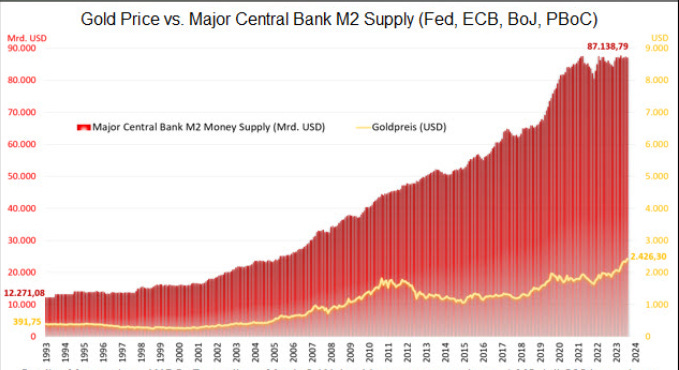

This is why the wealthy have been replacing their stock positions with gold since 2016 and even before. Central banks are also hoarding gold at never-before-seen levels. The transition memo was handed out long ago.

https://finance.yahoo.com/news/behind-gilded-curtain-why-billionaires-211633638.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuYmluZy5jb20v&guce_referrer_sig=AQAAADuLYxC099gt85x3MRQnqXa-wQNdqq6Vw1vx7pImCG6NCZy34RogMdz1MSFO_z-SJNfgdLUEBF6_MJnOgBIDPk8AMww-IKeI86x0FlnA8JgJWEtxHQccVWjMb4mhxMR5li3V6KeaOjLz5BxvpthhOM7ik_AdilPA1UaE7y0qKWQW

https://markets.businessinsider.com/news/commodities/de-dollarization-global-central-banks-are-hoarding-gold-like-never-before-2023-10#:~:text=1%20Global%20central%20banks%20have%20been%20buying%20record,drive%2C%20led%20by%20countries%20including%20China%20and%20Russia.

https://www.forbes.com/sites/roystonwild/2024/04/30/gold-demand-hits-highest-since-2016-in-q1world-gold-council/

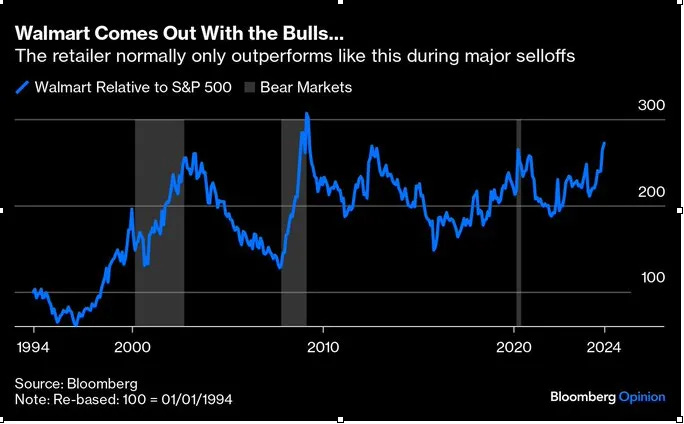

Great observation from John Authers in his must read; ‘Points of Return’ comment.

Walmart invariably outperforms when the market is selling off and the economy in trouble. Hence this year's outperformance should be a warning that all is not well with the soft-landing narrative.

https://x.com/albertedwards99/status/1843208666180374852

Out of everything we have to look at and witness, we don’t need Walmart to tell us we have an issue though do we…

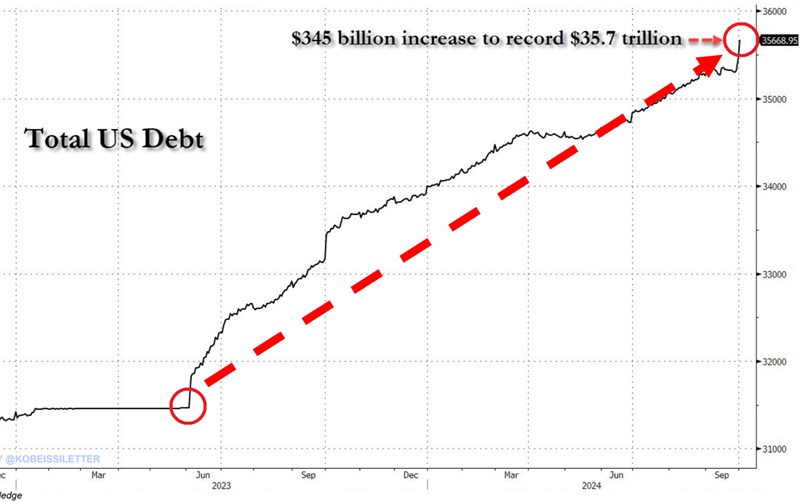

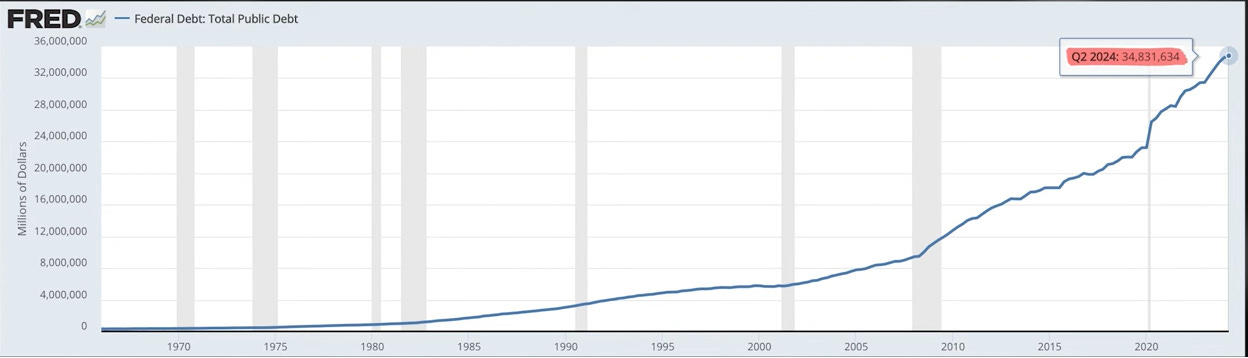

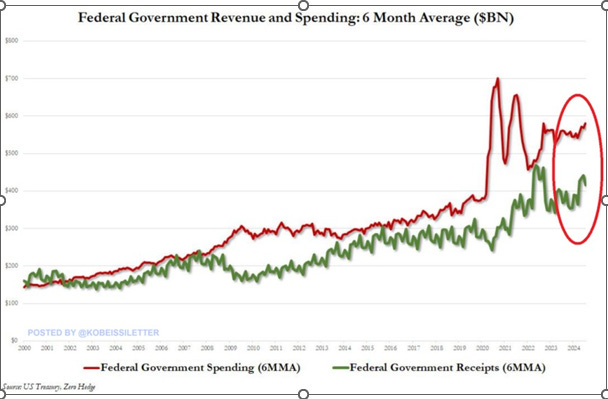

So much for “QT”: Hello 2nd Wave of Hyperinflation

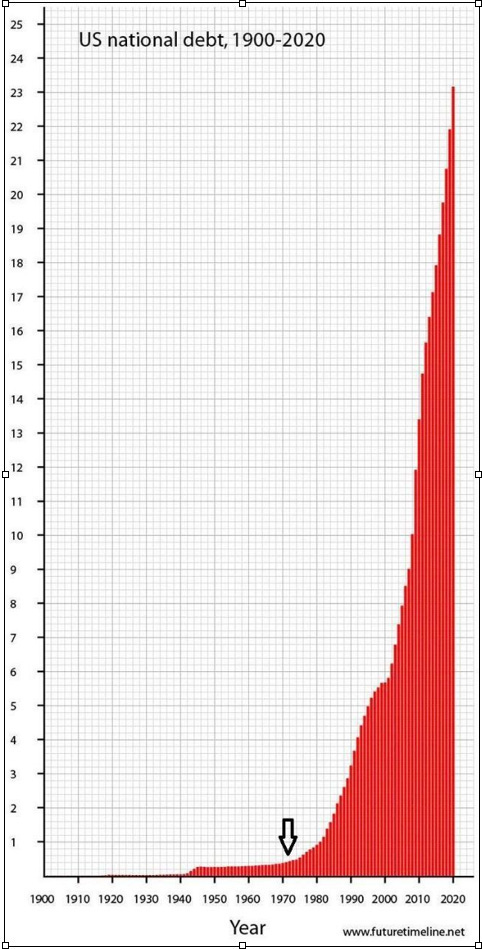

US public debt has jumped $345 billion over the last 3 days hitting another record of $35.7 trillion.

Since June 2023, federal debt has surged by a MASSIVE $4 trillion, or 14%.

Over the same time period, US GDP is up just $1.5 trillion, or ~6%.

In other words, the national debt has outpaced the economic growth by 2.7 TIMES over the last 16 months.

Outside of the pandemic crisis, US federal debt has never grown so rapidly.

Bill Holter

“Let me put his into perspective. If you add up all the global GDP’s, we are at roughly $100 trillion. The problem is there is well over $350 trillion in debt worldwide. When I graduated college, anything above 100% debt to GDP was considered a banana republic. Look where we are today. Globally, it’s 350% debt to GDP. What that tells me is the world is a banana republic.”

Interview: https://usawatchdog.com/whole-world-is-a-banana-republic-bill-holter/

M2 Money Supply Rises Again Along with M2 Velocity

In the week ending 02/09/2024, the US money supply M2 rose at a rate of +2.2% year-on-year. Compared to the previous week, M2 rose by +103.8 billion dollars to 21.171 trillion dollars.

The development of the M2 money supply in the weekly chart, from January 1982 to September 2024, in percent compared to the same month of the previous year.

Money and credit supply contractions have a recessionary effect and stifle economic growth, especially when interest rates are high.

The Fed has now lowered interest rates by 0.5%, which will lead to new expansions in the money and credit supply further feeding Hyperinflation.

Rising US money supply and, above all, a rising global money supply, are associated with rising asset prices, such as equities and gold.

Highly valued equities in the US in particular continue to be subject to a certain risk due to recessionary trends and the associated fall in corporate profits.

The Fed, not the consumer/population, are holding markets up. So in reality, markets have technically already crashed/collapsed.

The development of the outstanding credit volume of US banks in the weekly chart since 1974. Most recently in the week ending 11.09.2024, the credit volume grew by +3.1% compared to the same week of the previous year.

Source data:

https://fred.stlouisfed.org/series/WM2NS#0

https://fred.stlouisfed.org/series/TOTBKCR

Even the Big Players Are Hinting to Flee the Dance Floor

US Housing Market is in Purgatory

Some mistakenly believe they are sitting on wealth, while others can no longer afford a house: both are sitting on hyperinflation!

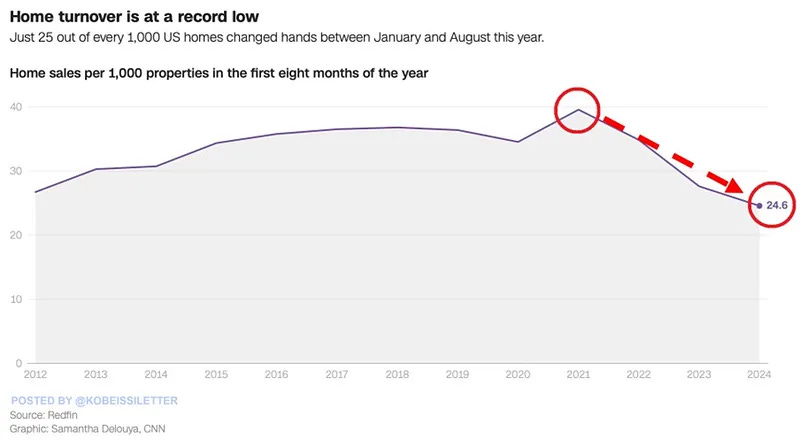

US home turnover is historically low: Only 25 out of every 1,000 US homes changed hands between January and August this year, the lowest turnover in at least 30 years.

Over the last 3 years, the rate of home sales has declined by 37.5% and remains ~30% below pre-pandemic levels.

Los Angeles had the lowest turnover among metros where just 15 out of every 1,000 homes changed hands in the first 8 months of the year.

Meanwhile, the rate of homes being listed for sale hit 32 out of every 1,000, the lowest in at least 12 years.

Elevated mortgage rates, record prices, and low supply are the main reasons for historically low turnover and listings.

Americans Can’t Afford Homes; “You’ll Own Nothing and be Happy” in Effect

https://www.cbsnews.com/news/housing-market-2019-americans-cant-afford-a-home-in-70-percent-of-the-country/

https://www.cnbc.com/2017/07/13/harvard-study-heres-how-many-americans-cant-afford-housing.html?msockid=27aafeb4acbc6afb05caea0cadf56b12

https://www.cbsnews.com/news/homes-for-sale-affordable-housing-prices/

https://www.cbsnews.com/news/real-estate-home-prices-middle-class-affordability-2022-02-23/

https://markets.businessinsider.com/news/commodities/housing-market-outlook-mortgage-rates-homeowners-investors-real-estate-property-2023-8

https://www.cnn.com/2021/03/23/opinions/millennials-almost-impossible-to-afford-home-olson/index.html

And people wonder why younger generations living in their cars have given up and are turning to nihilism…

https://medium.com/the-midnight-garden/why-are-so-many-americans-living-in-their-cars-861438cba3f1

End of Fiat; Rush to Gold

Context:

CHINESE FIAT MONEY 740 BC

The Chinese people had to painfully learn the importance of gold. China was the first country to introduce fiat currency during the Tang Dynasty in 740 BC. The value of Chinese fiat money remained stable until the Yuan Dynasty in the 13th-14th centuries. Then came the first period of Chinese hyperinflation because vast amounts of money were printed to finance wars.

Later in the 1930s and 1940s, Chinese money completely lost its value as Chiang Kai-shek's rule came to an end.

He was president of mainland China from 1928-1949.

Chiang moved in with splendor and glory.

By 1929, 49% of the state revenue consisted of loans.

After the Japanese invasion, the financial situation deteriorated further.

In the last years of Chiang's rule, the Chinese economy collapsed and money was printed without restraint.

In 1934, one US dollar cost 3.4 yuan, but by 1949 it was worth 23 million yuan.

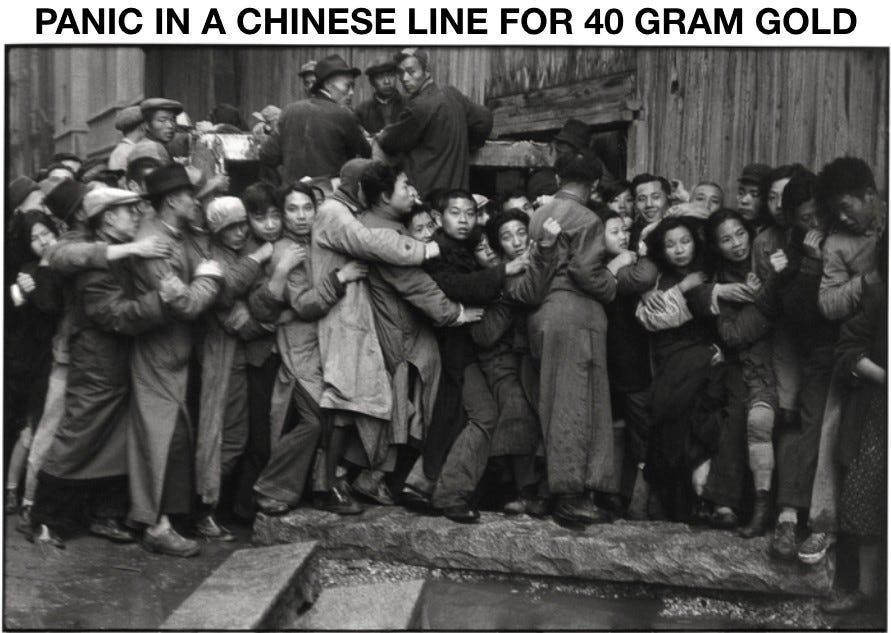

THE CHINESE GOLD QUEUE

During this hyperinflationary phase, when there was a drastic deterioration in economic conditions, the Chinese began to understand the importance of gold.

Photographer Henri Cartier-Bresson captured a real Chinese gold run in his famous picture below.

In December 1948, when the currency became worthless, the Nationalist government decided to issue 40 grams of gold per person.

As seen in the photo, utter panic broke out as people scrambled to get their hands on the life-saving gold;

many were crushed in the process.

CHINESE LEARNED VALUABLE LESSON FROM 1930s HYPERINFLATION

The picture was taken 70 years ago; many of the people desperately waiting in long lines to get their 40 grams of gold (just over an ounce) are no longer alive today. However, they, and all other Chinese who were in the same situation, will have told their children about the consequences of hyperinflation, because they had all experienced poverty, famine, disease and misery firsthand. These events had a major influence on China buying more gold than any other country in the world today.

Since that period of wars and mismanagement, China has risen to become an economic superpower over the last few decades. Unlike in the West, the Chinese have had to learn the hard way that money earned should not only be spent on consumer goods, but also saved for a rainy day. For this reason, a large number of Chinese also regularly buy gold to hold over the long term.

History repeats…and then some

https://www.economist.com/china/2024/04/25/chinas-young-people-are-rushing-to-buy-gold

https://www.nytimes.com/2024/05/05/business/china-gold-price.html

Americans are also panicking due to the subconscious realization of Hyperinflationary Depression taking over their lives since 2020. The populace is just now deciding to BEGIN acting on this realization as the Chinese once did and are today.

https://www.cbsnews.com/news/costco-gold-bars-selling-out-heres-what-they-cost/

NOTE:

Why 2020 for the beginning of US Hyperinflation? (1); 80% of all US currency to ever exist was created in 22 months (2020-2021) and did absolutely nothing to “stimulate growth”. At the same time, (2); M2 velocity was the lowest ever recorded in history, just before it begins shooting up rapidly and consecutively, from a historical low not long after. (3); Inflation was also beginning to break records in 2020-2021. Add all 3 together.

https://www.bls.gov/opub/mlr/2023/beyond-bls/what-caused-inflation-to-spike-after-2020.htm

Creating 80% of all US Dollars to exist in 1 year + Rapid consistent increase of M2 velocity from a historical low + already historically high inflation = Hyperinflation.

How does this possibly translate to gold?

This is why Mcdonalds prices have risen a minimum of 141% over the past 5 years alone

https://www.newsweek.com/mcdonalds-inflation-economy-price-increase-joe-biden-1905209#:~:text=These%20increases%20exceed%20the%20general%20average%20for%20inflation,has%20increased%20by%20an%20average%20of%20141.4%20percent.

Why Fast Food is now considered a luxury for Americans

https://www.foxbusiness.com/economy/americans-consider-fast-food-luxury-high-prices

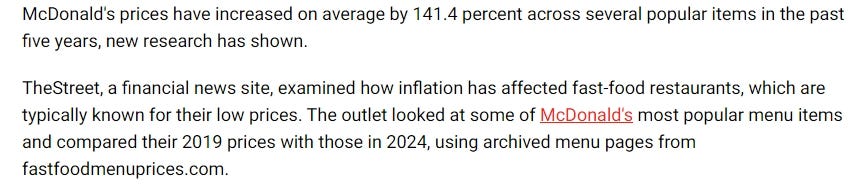

In reality as Fiat paper dies domestically (and globally)…

https://fred.stlouisfed.org/series/CUUR0000SA0R#

Central Banks promise their current product (Fiat-USD) is not collapsing.

That their new product (CBDC) is nowhere near ‘Roll-out-Ready’ and that they have no nefarious purposes or intentions.

You would be foolish to believe this because it is a lie/propaganda. Psychological Warfare.

In reality, the Fed has Central Bank Digital Control (currency) ready to roll out and they do plan on spying on you.

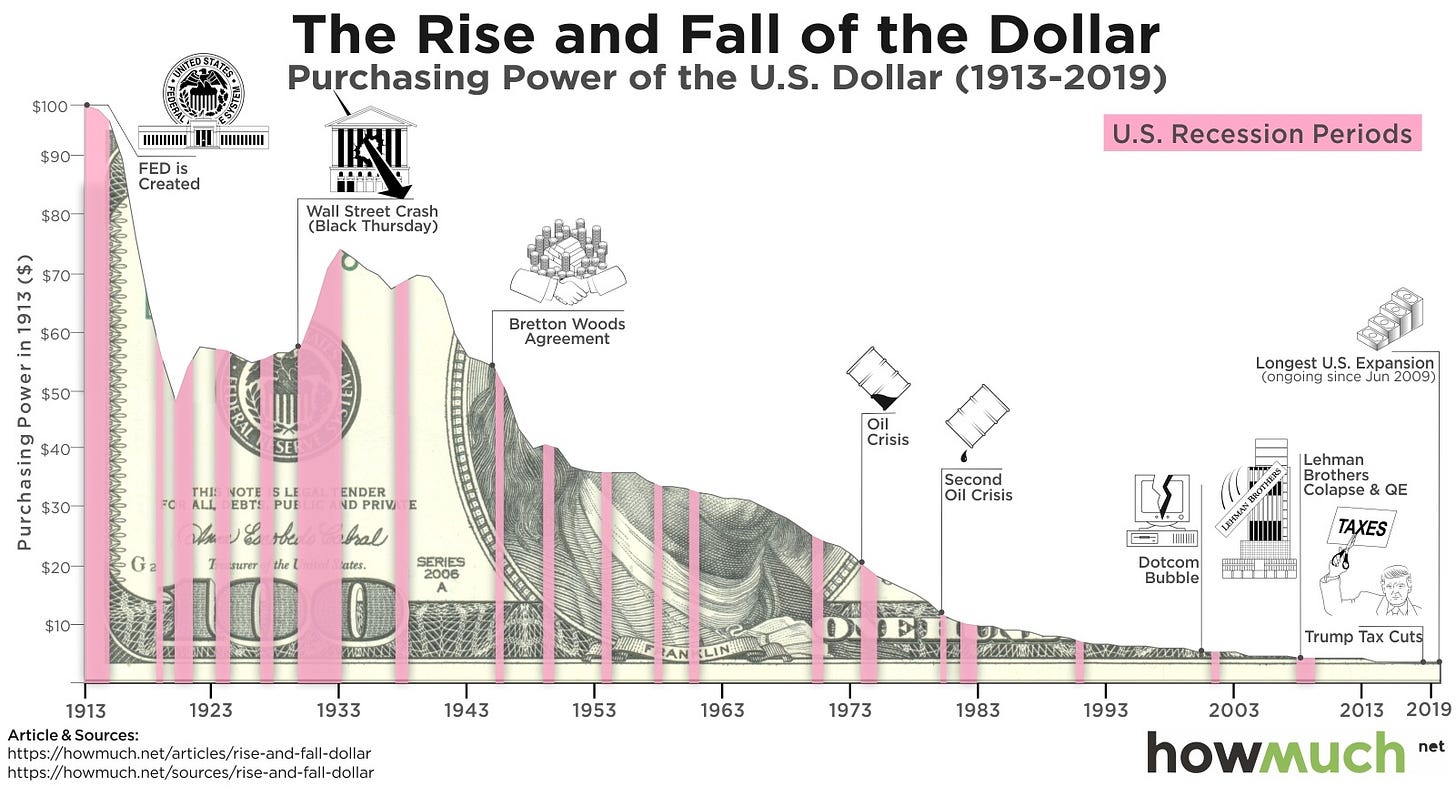

Hence the Consolidation of the Banking system for centralized control of CBDC.

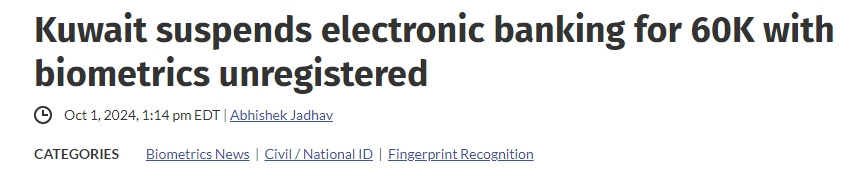

Take Kuwait for example…

https://www.biometricupdate.com/202410/kuwait-suspends-electronic-banking-for-60k-with-biometrics-unregistered

This is where all this is going while they tell you its not.

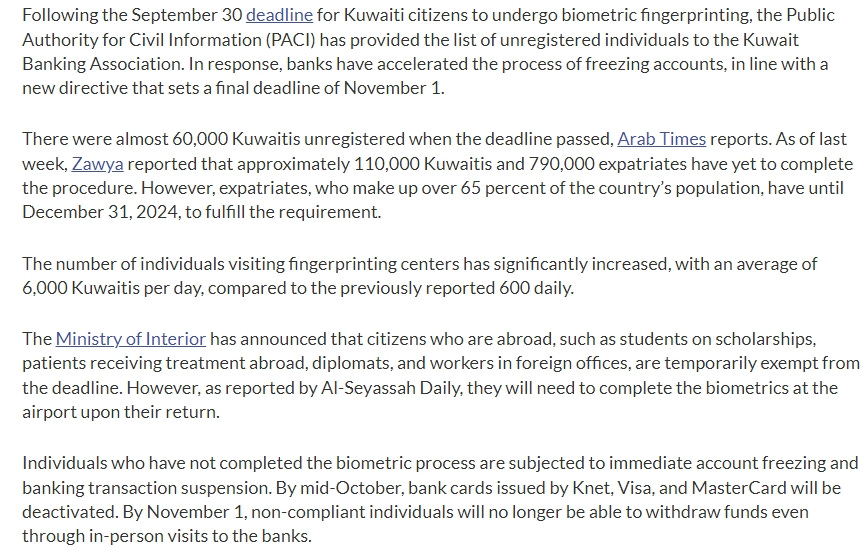

Inflation is beyond the Hand of the Fed

Hyperinflationary spike (far right blue)

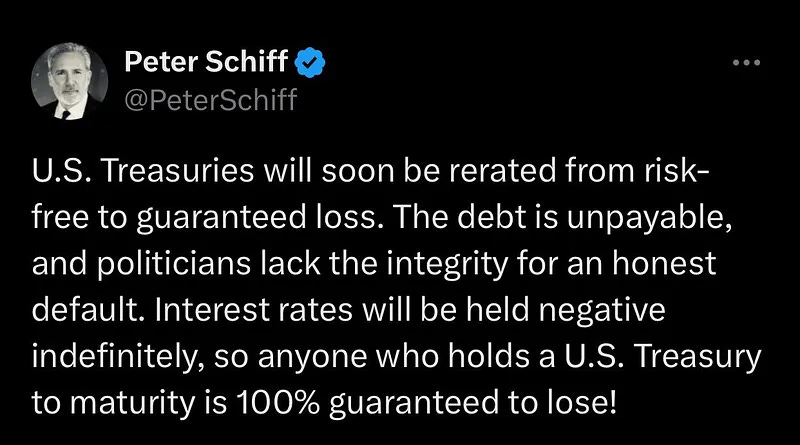

Real rates have been negative as the real inflation rate has far exceeded yields for quite some time.

Global Transition Incoming…

https://www.thegoldobserver.com/p/nations-in-the-mbridge-project-are

Why is there a Transition coming?

Because the world reserve currency USD has already collapsed (negative purchasing power) and is Hyperinflating as foreigners return to gold/alternatives to USD and its systems.

Gold offers stability among unstable practices by The Federal Reserve

Revaluation of gold is unavoidable…

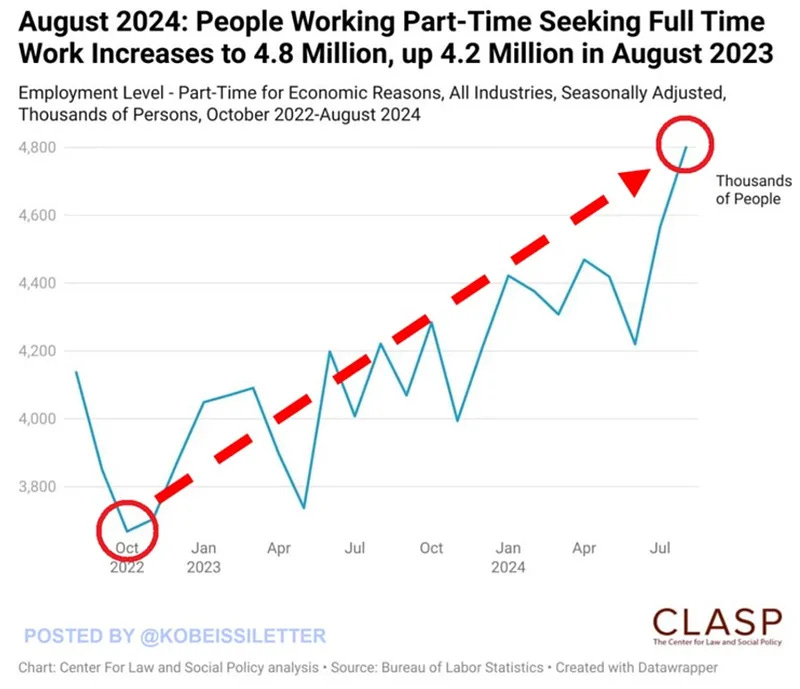

As the economy collapses, full time jobs disappear and part time increases…

Notice the trend of this also follows the hyperinflationary trend of other charts.

When full-time jobs disappear because the economy is collapsing, the government obviously lies about it to try and cover it up.

https://www.usatoday.com/story/money/2024/08/21/jobs-report-revision-growth-lower/74886965007/

They will tell you they added nearly a million jobs to the economy hoping you believe it and then quietly correct the fudged numbers hoping you don’t see it.

On top of job losses due to A.I.